On both hedging and speculation basis, strips at this stage would be best suitable.

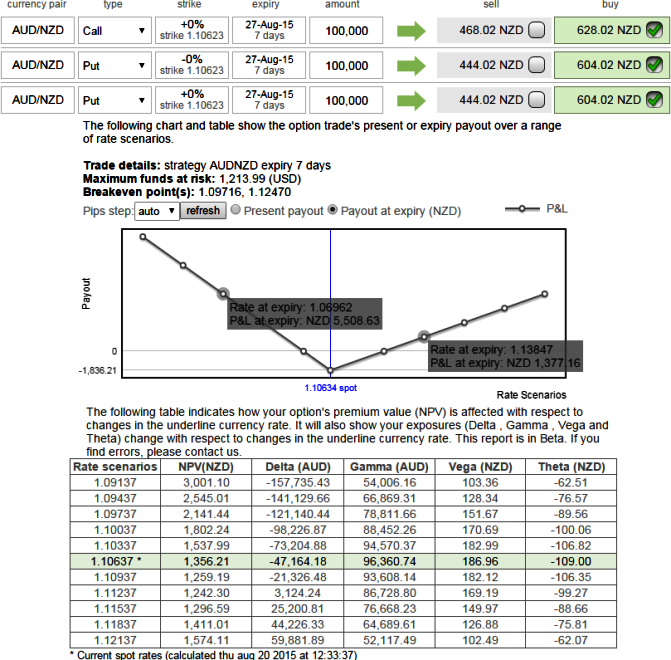

Hold 7D At-The-Money -0.50 delta put and hold one more lot of 15D At-The-Money -0.50 delta put options and simultaneously 15D At-The-Money 0.5 delta call after squaring off 1st put option. The rationale being quite simple in near term the pair may experience slight upswing momentum but we foresee stringent declines in medium term future.

Dear readers, it is all about timing the market so as to follow the trend direction, since this strategy involves buying a number of ATM calls and double the number of puts but the timing of acquiring call would be after the first put attaining its maturity. The strip is more of customized version combination as we maintained less time for call so that the option premiums will have economic pricing and more bearish version of the common straddle.

Huge profits achievable with the strip strategy when the underlying currency exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move. Hence, any hedger or trader who believes the underlying currency is more likely to plunge downside can go for this strategy.

FXWirePro: AUD/NZD calendar strips to serve both hedging and speculation

Thursday, August 20, 2015 7:06 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside  Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone

Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone  FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo

FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo  FxWirePro: GBP/USD slides as UK political uncertainty weighs on pound

FxWirePro: GBP/USD slides as UK political uncertainty weighs on pound  FxWirePro: EUR/NZD recovers slightly but bears are not done yet

FxWirePro: EUR/NZD recovers slightly but bears are not done yet  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize  AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip

AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip  FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook  FxWirePro: NZD/USD edges up, remains on front foot

FxWirePro: NZD/USD edges up, remains on front foot  FxWirePro:EUR/AUD neutral in the near-term, scope for downward resumption

FxWirePro:EUR/AUD neutral in the near-term, scope for downward resumption  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro: GBP/AUD key support held, downside risk remains

FxWirePro: GBP/AUD key support held, downside risk remains  FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data

FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data