LatAm currencies have been the worst performing so far this year, rekindling fears that they are backsliding into 1997 crisis mode. Commodity prices rout has contributed significantly to this performance. The worst hit currencies (RUB, COP, BRL) lost between 8% and 10% against the EUR and USD.

First-round effects of weaker commodity prices have been seen already - on the whole REERs have adjusted alongside terms of trade. However, lower commodity prices have opened the floodgates for a slew of other issues in the region: domestic growth, fiscal accounts, and external accounts.

Domestic growth has weakened over recent months. Latin American GDP forecasts have been consistently revised lower throughout the year. This will weigh on investment in the countries, which in turn feeds into the second two risks, weaker fiscal and current accounts.

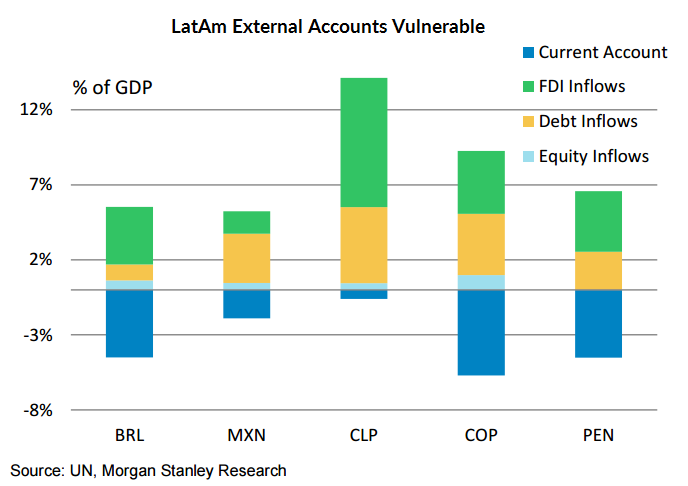

A sharp rise in corporate debt levels over the past decade, in particularly in Asia and Latin America, brings the threat of an external funding shock as the Fed prepares to raise interest rates as soon as September. Oil and major commodity price baskets are now threatening the lows of early 2009, posing the risk of further abrupt currency weakness and spiralling bond yields for exporters of natural resources and countries with large current account deficits. Latin America is particularly vulnerable to declines in commodity prices and therefore growth because of its large current account deficit.

Funding this exposure was fairly straightforward between roughly 2004 and 2012, as the commodity supercycle boomed and global liquidity was flush. However, as commodity prices fall, this will directly impact FDI funding via reduced opportunities, and indirectly via weaker growth prospects. This puts the onus on portfolio funding at a time when global liquidity is set to tighten once the Fed begins to hike rates.

"Initial direct impacts of weaker commodity prices may be in the price for LatAm FX. However, we don't think that current levels fully reflect domestic growth prospects, fiscal risks, or external vulnerability", said Morgan Stanley in a research note to its clients.

On top of this, political risks are growing virtually in every country in the region as can be seen by the slew of recent corruption scandals across Latin America. In most countries, a weaker currency is not only warranted, but also a key component of the macro-adjustment process.

"We believe there is further to go in LatAm FX depreciation", added Morgan Stanely.

Falling Commodities to fuel further LatAm FX depreciation

Tuesday, August 4, 2015 10:00 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand