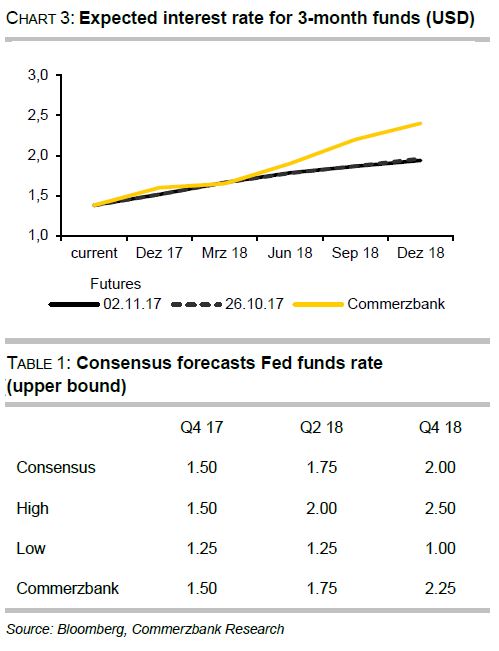

The Federal Open Market Committee’s (FOMC) October 31-November 1 monetary policy meeting brought the expected confirmation of Fed policy. The Fed left its funds target corridor at between 1.00 percent and 1.25 percent. The Fed Funds rate is expected to reach the 2-2.25 percent range by the end of next year, Commerzbank reported.

The statement released after the meeting signaled a more upbeat view of the economic situation. The Fed now sees the economy growing at a “solid” pace despite the impact of the severe storms. The September statement still spoke of “moderate” growth.

The US economy expanded at a rate of 3 percent in both Q2 and Q3. Based on this solid trend in economic activity, the Fed assumes that the labor market will continue to develop positively; the central bank specifically pointed to the further decline in the unemployment rate in September. However, inflation still hovers below the 2 percent mark. While the Fed sees no imminent change on this front, it still assumes that inflation will stabilize at 2 percent over the "medium-term".

The Fed said the risks to the economic outlook are thus "balanced" – a keyword for further policy normalization. All the signs point to a rate hike in December, at the next FOMC meeting, which markets have long expected. This hike would be the fifth rate move in this cycle.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy