Chair Yellen's semi-annual report to Congress provides an opportunity to glean further understanding of the outlook for policy; in particular, it provides an in-depth assessment of the FOMC Chair's core beliefs and what she sees as the key risks.

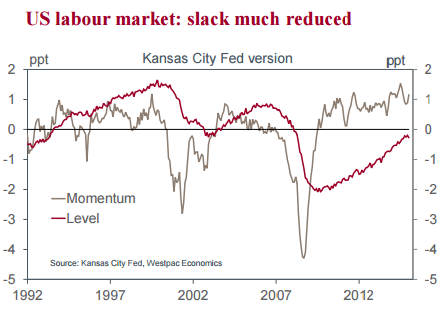

On the labour market, her confidence remains clear. Specifically, she emphasised that there had been a notable improvement in the labour market, with "more than 12 million jobs" created, resulting in the unemployment rate declining by "more than 4½ ppts from its 10% peak in late 2009". While "some slack" remains, further gains are anticipated, bringing into view the prospect of 'full employment'.

On price pressures, "inflation continues to run below the Committee's 2 percent objective"; this is particularly true of headline PCE inflation which, at May, was just 0.25%yr. However, "the recent low readings on total PCE inflation reflect influences that are likely to be transitory, particularly the earlier steep declines in oil prices and in the prices of non-energy imported goods". Supporting this view: "energy prices appear to have stabilized recently"; further, Chair Yellen believes that the impact of the currency on inflation is likely to lessen as global growth firms.

The backbone of the FOMC's positive outlook remains the US consumer. On this point, Chair Yellen has been quite vocal, both in the June press conference and in her semi-annual testimony.

Balancing the risks to the outlook for policy is the global backdrop. Stating the obvious, "the situation in Greece remains difficult"; on China, Chair Yellen cited "the challenges posed by high debt, weak property markets, and volatile financial conditions". But it is important to recognise that, as Yellen highlighted, the FOMC was "aware of these developments in June", when they saw the risks around their central tendency forecasts as balanced overall. So there would need to be a further deterioration in the global backdrop and a reassessment of FOMC members' views on the impact of such trends at home for hikes in 2015 to be eschewed altogether.

While the FOMC has not committed to raise rates "at any particular time", "[if] the economy evolves as expected, economic conditions likely would make it appropriate at some point this year to raise the federal funds rate" emphasises that Yellen's FOMC is on the cusp of making their first move. But they are also seeking to give context to their actions with, "[w]hat matters for financial conditions and the broader economy is the entire expected path of interest rates, not any particular move, including the initial increase". How term rate expectations adjust to these initial increases will have a far greater effect on the economy than the first move(s) themselves - the lesson of 2013's taper tantrum. This is what will determine the timing and scale of the normalisation process. All of this is to say that the path of the policy rate after lift-off remains highly uncertain, with real economy momentum; confidence; and expectations key.

Fed chair Yellen firm on the consumer and an impending first move

Thursday, July 16, 2015 12:41 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX