European Central Bank's (ECB) unprecedented easing, which has unleashed more than €250 billion of liquidity in Euro zone seems to be working its magic for the economy as well as almost all subsectors, as per latest data from Markit economics.

According to sectorial PMI research,

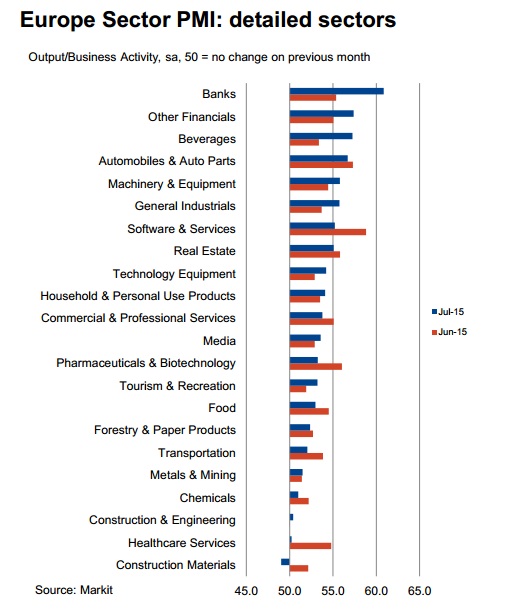

- In July, Banks topped sectorial rankings, suggesting ECB's easing finally sipping into the performance of the sector, which is expecting better business days ahead. Financials were the fastest growing broad sector.

- Data also pointed out that consumers are warming up to better economic days as strong expansion in output were registered in beverages to Automobiles to Tourism.

- Commercial sectors seem to be improving to with expansion seen across industry, with greater expansion for machinery and equipment.

- Construction, however continues to lag and even contracted in July from June.

In spite of rate hike from FED and all global headwinds, European stocks are likely to outperform going ahead, especially after the rate hike from US Federal Reserve.

KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking

KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking  Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements

Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBA Signals Further Interest Rate Hikes if Inflation Persists, Says Governor Michele Bullock

RBA Signals Further Interest Rate Hikes if Inflation Persists, Says Governor Michele Bullock  Trump Offers U.S. Insurance and Naval Escort for Tankers as Strait of Hormuz Crisis Disrupts Global Oil Trade

Trump Offers U.S. Insurance and Naval Escort for Tankers as Strait of Hormuz Crisis Disrupts Global Oil Trade  BOJ Rate Hike in March? Yen Weakness and U.S.-Japan Summit Add Pressure

BOJ Rate Hike in March? Yen Weakness and U.S.-Japan Summit Add Pressure  Bank of Japan Signals Further Interest Rate Hikes as Inflation Trends Toward 2% Target

Bank of Japan Signals Further Interest Rate Hikes as Inflation Trends Toward 2% Target  The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever  Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears

Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears  Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise

Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise  Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears

Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears  Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply