Fitch cut its sovereign rating on Brazil to BBB- today, with a negative outlook - indicating another downgrade into junk remains a risk for the coming months. Fitch stated the key drivers for the rating downgrade as a reflection of "Brazil's rising government debt burden, increased challenges to fiscal consolidation and a worsening economic growth backdrop."

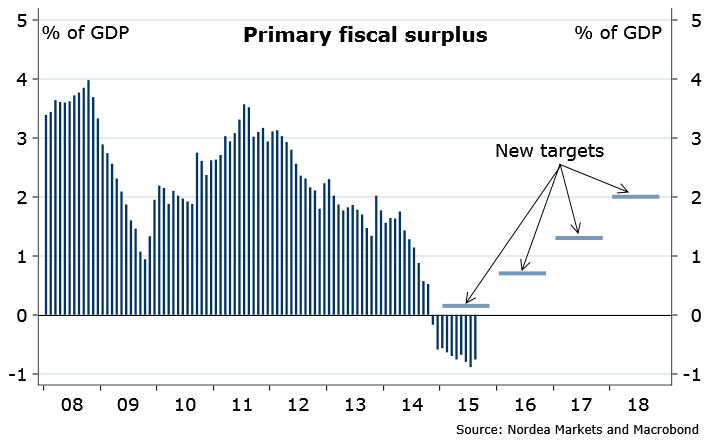

The deep economic downturn, and difficulties in reaching support in Congress to pass through any meaningful fiscal reforms has impaired the government's efforts in reaching fiscal consolidation and reining in the growing government debt stock. It looks highly unlikely at the moment that the government will be able to reach its much lower and weaker fiscal targets of 0.7% respectively 1.3% of GDP for 2016 and 2017. Fitch expects the economic and fiscal underperformance to persist, and therefore keeps the outlook on negative. Factors that could lead to a downgrade into junk are further growth-underperformance or difficulties in reaching fiscal consolidation and continued political risks undermining policy-making.

S&P earlier this summer cut Brazil's sovereign rating to junk. With the downgrade from Fitch today, both Moody's and Fitch keeps Brazil just one notch above junk. Economists see risks as high in the coming months of another downgrade of the sovereign rating into junk status by at least one of the two institution, since the outlook for Rousseff's government to drive through the needed fiscal reforms through Congress looks weak at the moment. Rousseff's approval ratings are at single digits and the opposition is constantly trying to find ways to call for her impeachment.

"Weak domestic fundamentals, the risk of more rating downgrades, pressure from the drop in commodity prices and the upcoming Fed hikes is likely to keep the BRL under pressure. We recently revised our 3M and 6M forecast for USD/BRL to 4.1 and 4.00. We see very moderate strengthening beyond the near term as external pressure eases, but domestic issues persist", says Nordea Bank.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed