Since World War II, the average length of time between recessions is 5 to 6 years. With the current cycle clocking in at 81, it's natural to wonder if the next downturn is imminent.

Global inflation has begun to reflect recessionary levels (around 1% Y/Y change).

Global trade has collapsed as reflected by the 80% drop over the last 18 months.

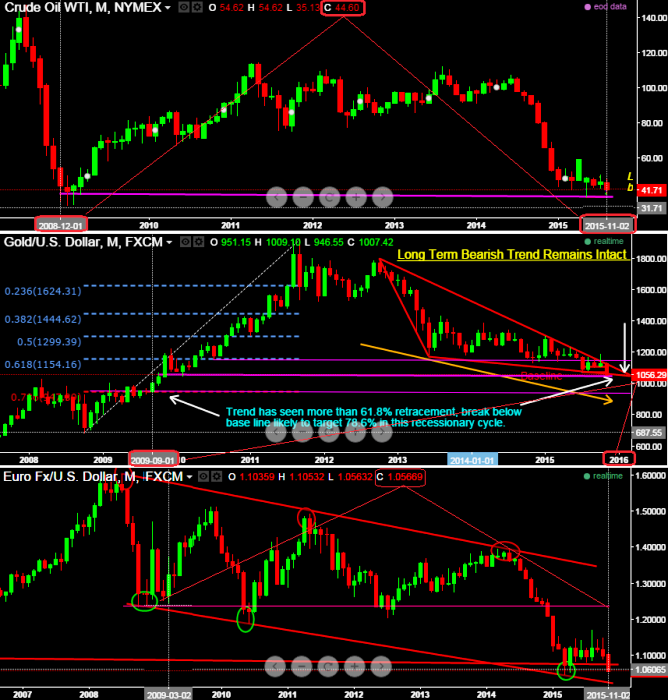

Declining trend over various asset classes (Bullion, crude and equity indices); compare the current levels with 2008 when last recession took place (see technical charts).

Recessionary trends are appearing in overall US imports/exports.

China's economy appears to be turning recessionary, recent currency devaluation has been the evidence so as to protect their economy.

In Germany, Europe's strongest economy, exports fell 5.2% in August from the previous month, growth momentum for been in the recessionary mode.

Japan already seems to have entered into the recessionary phase; industrial output disappoints projections (1.4% versus forecasts 1.9%).

It seems that the slow growth in snail's pace is only a momentary result of the 2008 financial crisis is absurd, this is no room for complacency.

The latest data suggest growth is slowing in the United States, and it is already slow in Europe and Japan. A global economy near stall speed is one where the primary danger is recession.

Flurry of reasons to ponder over global markets sensing recessionary phase

Monday, November 30, 2015 12:31 PM UTC

Editor's Picks

- Market Data

Most Popular

AI is already creeping into election campaigns. NZ’s rules aren’t ready

AI is already creeping into election campaigns. NZ’s rules aren’t ready  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever  Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000  Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight  Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes