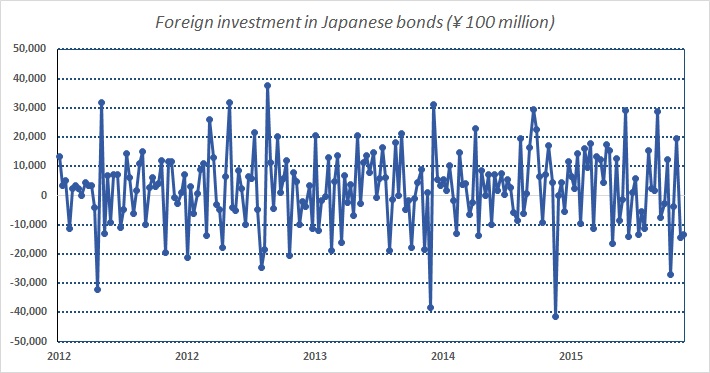

Latest data from Japan's Ministry of Finance (MoF), shows that after turmoil in August and withdrawing big ticket money out of world's second largest bond market, investors are once again back into Japanese bonds.

Investors over the years, have shown confidence in Japanese bonds over its liquidity and market depth and since 2012, Bank of Japan's (BOJ), Qualitative and Quantitative Easing (QQE) has increased the incentive to long Japanese bonds.

In its policy meeting this week, BOJ has held policy steady and hasn't provided any further cues what it might do going ahead. A number of analysts, economists and investors such as Goldman Sachs has called for further expansion of its QQE program from current ¥ 80 trillion per annum in its next monetary policy meeting, which is scheduled on October 30th.

Japanese 10 year yield is currently trading at 0.32%, down 2.1% for the day so far and Japanese 2 year yield is at 0.01%.

However in last two reported week there has been large net outflow from bonds. In last two weeks almost ¥ 2.7 trillion has flown out of the market, especially in the shorter end.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings