Swiss economy has started showing signs of Franc shock sipping through real economy. Swiss National Bank (SNB) unexpectedly removed 1.20 EUR/CHF peg, leading to heavy appreciation in Franc's value.

- CPI and PPI released last week shows deflation in Swiss economy has accelerated at fastest pace since 2208 crisis. For April producer price index dropped -5.2% from a year ago. Unemployment rate has ticked up by 0.1% for first time in many months. PMI remains in contractionary zone since January.

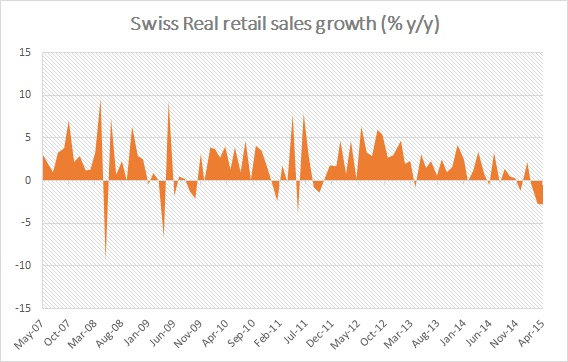

Today's retail sales release painted similar picture.

- Real turnover in the retail sector fell by 2.8% in March 2015 compared with March 2014. Drop was -4.6% in nominal terms. Real, seasonally adjusted turnover in the retail sector rose by 0.7% in March 2015 compared with February 2015 Retail sales of food, drinks and tobacco registered a decline in real turnover of 2.6% and -3.2% in nominal terms, nonfood sector dropped by -2.3% and -4.8% in nominal terms.

Impact -

- Franc yield is the lowest in the world given deflationary pressure in Swiss economy. Swiss 10 year yield is trading at 50 basis points discount to benchmark German yield. Yield is expected to remain low for Franc unless further action from SNB push inflation expectation higher.

- Franc is currently trading at 0.92 against dollar and likely to remain relatively stronger.

- Swiss National Bank (SNB) is likely to take further measure to curb deepening deflation or it risks failing its mandate of price stability.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate