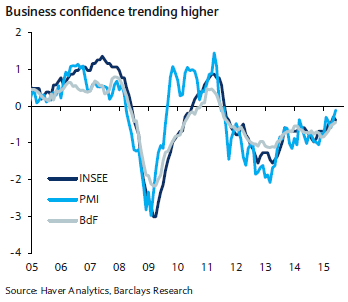

Despite some divergence in June, French business confidence indicators continued to improve, as manufacturing and services sectors are performing well.

Therefore, INSEE, Bank of France and PMIs anticipates the business confidence indicators to climb 2.3pts, 2.4pts and 1pt, respectively during Q2 15, notes Barclays. Stabilisation of order books in the INSEE survey (still rising in the PMIs) and of personal production expectations suggests that trend recovery growth is probably somewhere in between the likely volatility of Q1 and Q2 15 GDP prints.

The ongoing strengthening of business confidence bodes well for a recovery in business investment, and thus a rebalancing of the recovery in domestic demand. This is consistent with the INSEE quarterly investment survey, which pointed to an acceleration of investment to 6% in 2015 from 2% in 2014.

"While we think it is worth discounting (owing to temporary factors) some of 1.3pp jump in non financial corporations' (NFC) profit margin in Q1 15, we believe the upward trend that started in Q2 14 has some structural footing and will support a rebound in business investment as the recovery gathers pace and the industry capacity utilisation rate increases (+1.6pt, to 82.3%, in Q2 15), according to Barclays.

France business confidence indicators continued to improve

Thursday, July 23, 2015 9:59 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX