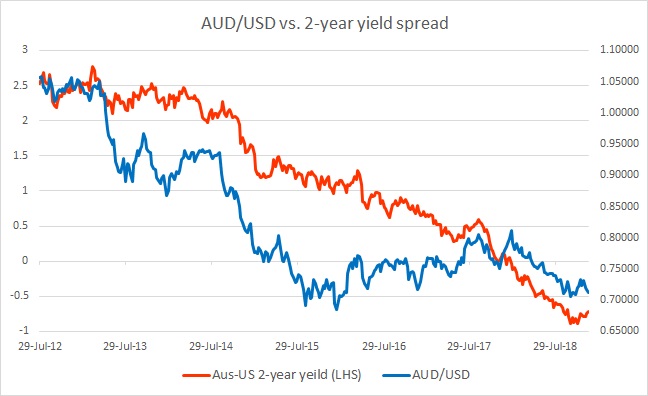

The chart above shows, how the relationship between AUD/USD and 2-year yield divergence has unfolded since 2012.

The chart above makes a clear case of closeness between the rate spread and the exchange rate. The spread between the 2-year U.S. Treasuries and the 2-year Australian government bond declined from +253 bps to -72 bps. AUD/USD responded by declining from 1.056 area to 0.729 area.

Recently, the spread has reversed course and the declining Australian dollar is reducing the divergence fast. If the spread continues its reversal, at one point Aussie is likely to find support in it.

In December, the spread declined by 17 bps to 71 bps in favor of the Australian dollar, but, Aussie declined by 200 pips to 0.712 area.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX