Recently the Riksbank decided to keep its repo rate unchanged at -0.35%. The central bank was expected to cut bank rate by 10 bp, says Nordea Bank. The bank revised down its CPIF forecast markedly for the coming 12 months without this triggering any policy response.

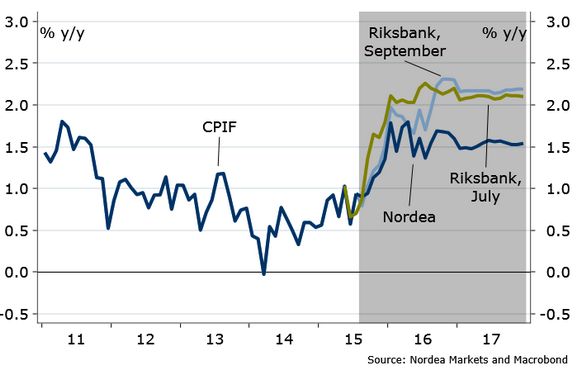

"The CPIF path was lowered for the rest of the year and by as much as 0.3% point for the period January-August 2016. CPIF inflation will reach 2% temporarily in early 2016 while it will not establish a level at or above 2% until September next year", foresees Nordea Bank.

The Riksbank notes that CPIF inflation can be expected to be "close to" 2% in 2016; this is a softer wording than in previous reports. One indication of the bank's softer stance is that inflation ex energy is given more emphasis than previously. The forecast for CPIF ex energy was also left broadly unchanged from the previous report.

Another reason seems to be that the Riksbank is more comfortable with the stronger economic activity and accelerating resource utilisation. The change in public opinion, from calls for stimulus to questioning the scope of the extraordinary measures, may also have played a role.

The signs that the Riksbank is approaching the point where it believes that enough has been done making additional measures less likely. Yet the krona remains a wild card for the bank. The trade-weighted krona rate (KIX) appreciated by nearly 2% after the Riksbank's announcement.

"As we see further krona appreciation ahead, we stick to our view that the Riksbank will do more and cut the repo rate by 10 bp to -0.45% at the October monetary policy meeting. In case of rapid krona appreciation, measures could be presented earlier", states Nordea Bank.

Further SEK appreciation likely

Friday, September 4, 2015 5:11 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed