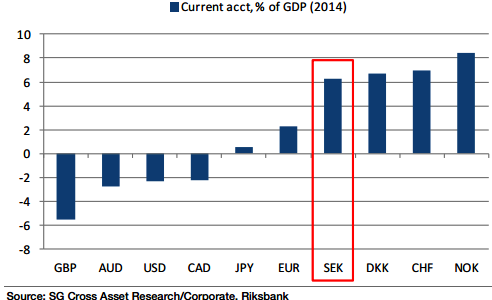

A surprise jump in Sweden's CPI inflation in July has helped the SEK to cut nearly half the Q2 losses against the USD and EUR. This resulted in a mild strengthening of the trade weighted Krona (KIX) over the past month despite the currency's high beta status. The current account offers support from risk aversion.

Underlying CPIF inflation rose to 0.9% yoy in July, two tenths above the Riksbank forecast. Swedish interest rates should stay on hold at -0.35% in the foreseeable future. The Riksbank kept rates on hold today. Can EUR/SEK extend to 9.20?

"Economic confidence surveys all surprised to the upside in August indicating solid growth prospects in the coming months. The SEK is among the cheapest currencies in REER terms but recovery prospects depend on wider risk sentiment", says Societe Generale.

SEK rallies as Riksbank pauses

Friday, September 4, 2015 3:48 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022