Crude Oil is pulling away from the market’s biggest storm in seven years. A measure of price volatility has tumbled from the highest level since January 2009 as the market frenzy eases amid a potential pact between the world’s largest producers to freeze output.

From last months, WTI crude’s attempts of bottoming out and consolidation phase are confined between $42.23-$51.91 range, while on the contrary bulls are not ready to give up the momentum and hold stronger at $42.23 levels. For now, as the price is stuck again in the range of 46.27 and 45.54 levels and with seesaw sentiments, at this juncture we think a very good chance of double touch barriers.

The uncertainty is lingering around this energy commodity owing to OPEC meeting. Asian energy stocks came under deep distress as the traders watching a meeting between the world's top oil producers in Vienna seen as crucial in supporting prices through output cuts.

As per the speculative standpoints, the OPEC members on Monday have failed to strike a pact on output cuts, with Iraq and Iran - OPEC’s second and third-largest producers.

On the flip side, the optimist laggards still have faith in OPEC would sign an accord to cut output, but skepticism remains over whether it would be adequate to cushion the crude market.

OPEC is striving to get member groups, along with non-OPEC member Russia, to implement coordinated production cuts aimed at reducing a global supply glut that has seen prices more than halve since 2014.

While US Energy Information Administration is likely to announce inventory levels of US crude stocks today during later US sessions. EIA crude oil inventories measure the weekly change in the number of barrels of commercial crude oil held by US firms. The level of inventories influences the price of petroleum products, last week it has collapsed from 5.3m to -1.3m barrels.

So, let’s not jump into conclusion to have open exposure in this commodity; instead, deploy ATM straddles to monitor puzzling swings amid significant economic news.

The Strategy:

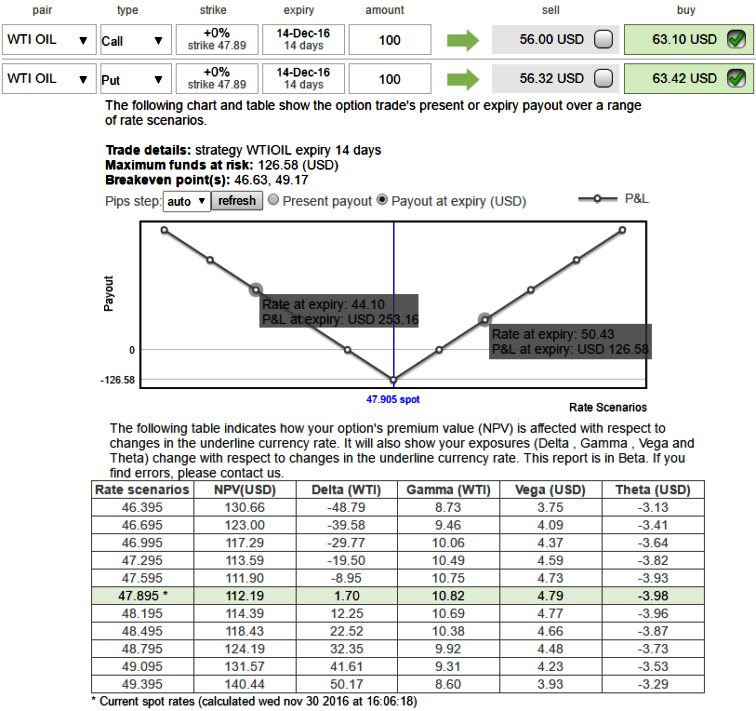

As shown in the diagram, buy 2w ATM +0.51 delta call and ATM -0.49 delta put of the same expiry at net debit.

The strategy derives unlimited returns with limited risk to the extent of initial premium paid that are used when the hedger ponders that the underlying commodity would experience significant volatility in the near term.

Rationale: Capitalizing on above stated fundamental news which is significant that could cause high yielding volatilities, so, we suggest trading the expectancy of increased volatility without taking a view on direction. A strategy commonly used over major economic announcements and events.

Risk/return profile: The profit increases as the underlying market rises or falls. The maximum loss is the premium paid for the options. The loss is less between strike price A and break-even points.

Effect of Volatility: The value of both options will increase as volatility increases (good) and will decrease as volatility falls (bad).

Effect of Time decay: The value of both options decay each day that passes (bad).

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential