We think in between all these macro level developments volatility in FX option markets is getting fueled up as the long lasting Greece matters came into a temporary resolution finally, and for now, since the focus shifted onto Fed.

Technical Glance and Hedging Perspectives:

Both on weekly as well as daily charts, swings getting narrowed along with the oscillating indicators evidencing proportionate convergence with price fluctuations on either side. On daily chart, slow stochastic reached overbought zone but there is trace of %D line crossover, instead both red and blue line moving as straight line. The major trend has been uptrend but some serious bearish candles are puzzling.

Hence, we believe Yen is waiting curiously to get benefitted from any outcome of the rate decision.

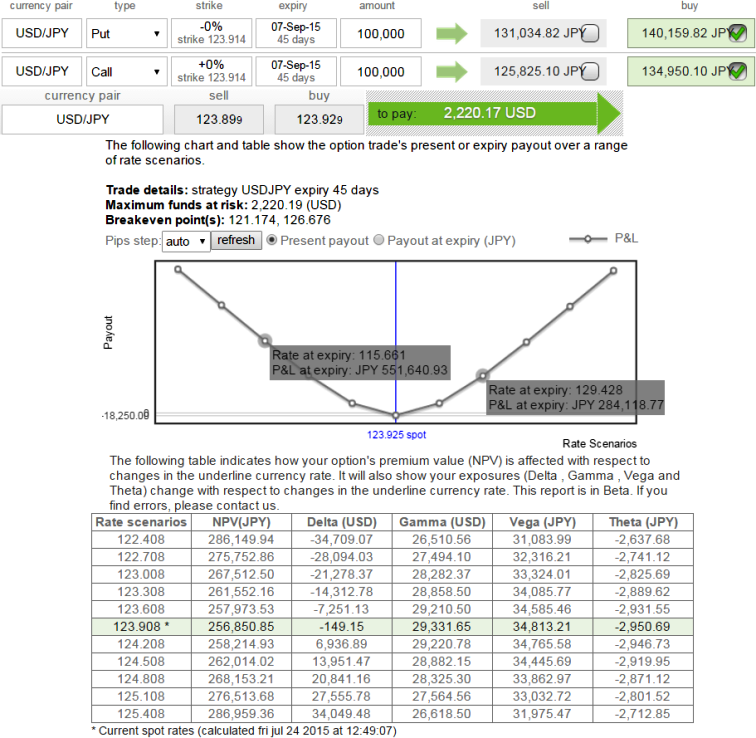

Deploy straddles using At-The-Money calls and puts in this dubious situation.

USD/JPY's long-term uptrend is persisting but because of bearish sensation we foresee non-directional trend is also puzzling around this pair on EOD charts. Since it should not damage the dollar gains we like to remain in safe zone and recommend buying a straddle as shown in the diagram using At-The-Money option contracts, thereby, one can benefit from certain returns even if the pair breaks out on either side in a long run.

Highest returns can be achieved when the spot exchange price of USDJPY is greater than strike price of long ATM call plus net initial debit Or when spot USDJPY is less than the strike price of long ATM put minus net initial debit.

FxWirePro: $/¥ long straddles as hedging means ahead of Fed’s big event

Friday, July 24, 2015 7:47 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings