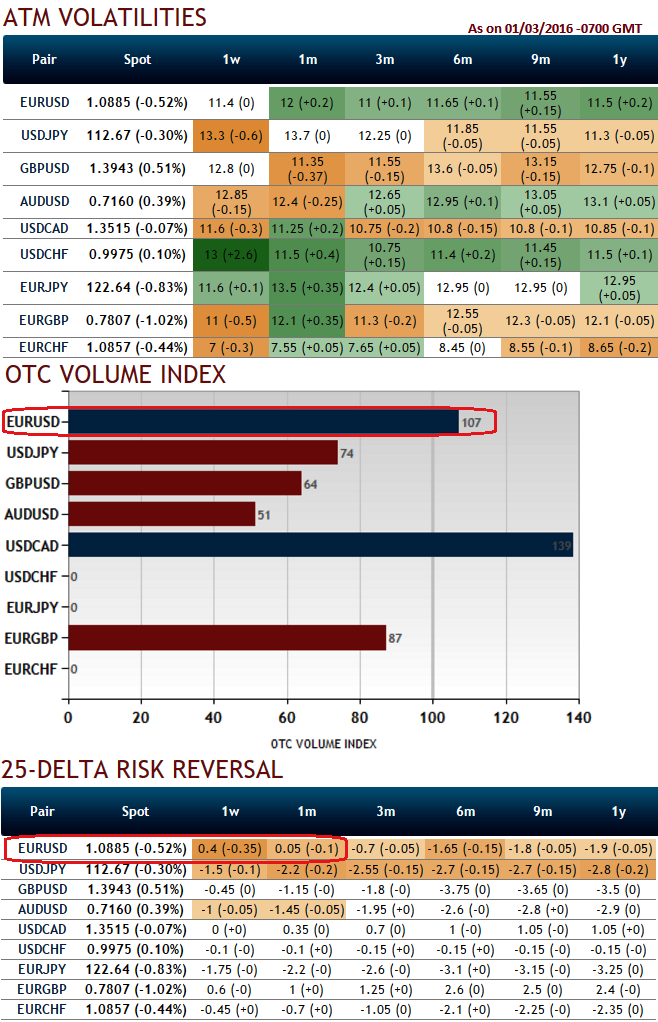

Please have look on the risk reversal nutshell, perhaps OTC market arrangements may baffle sentiments of the spot FX trend directions. For contracts expiring in 1W-1M are displaying little upticks, however, losing momentum drags back the bearish sentiments in long run. As a result OTM puts of 6M-1Y year expiries are trading relatively expensive.

You can even observe over the OTC VIX for EURUSD to have traded second highest volumes in FX options among G7 currency segment when IVs are above 11% throughout the tenors.

Hence, comparing this difference between implied volatility, OTC market sentiments, technical reasoning and in options premiums we think the arbitraging opportunity is generated.

Technically, the pair has been breaking the important supports 1st at 1.1063, and now on verge of breaking 1.0869 levels with current price to slip below 21DMA and 7DMA curves. While leading oscillators converge downward to these price dips.

Box Spread ratio: (Call - 1:1; Put - 1:1)

Strictly on hedging grounds, particularly, the long box spread is advised as the spreads are emphasized in relation to their expiration values.

A Box options spread consists of buying the call and selling the put at the same lower strike price and buying the put and selling the call at the same higher strike all within the same instrument and expiry month.

How to execute:

Go long in 1M EURUSD (1%) in the money call, Short 1M EURUSD (1%) out of the money call.

Simultaneously, Go long in 3M EURUSD (1%) in the money put, Short 3M EURUSD (1%) out of the money put options. (shorter tenor on call side and long tenor on put side adjusting perplexed risk reversals).

Essentially, the arbitrager is simply buying and selling equivalent spreads and as long as the price paid for the box is significantly below the combined expiration value of the spreads, a riskless profit can be locked in immediately.

FxWirePro: 25 Delta RR bullish in short term bearish in long run - EUR/USD box spreads to accommodate mixed bag of risk reversals

Tuesday, March 1, 2016 11:03 AM UTC

Editor's Picks

- Market Data

Most Popular