Bearish GBPJPY Scenarios, see slumps up to 138 levels if:

1) A no-deal Brexit (GBP down between 10-20%).

2) PM May resigns and is replaced by a harder-Brexiteer following the defeat of a Brexit motion in parliament, opening way to #1.

3) The US starts vehemently criticizing Japan’s trade surplus against the US.

Bullish GBPJPY Scenarios, see rallies up to 147 levels if:

1) The Withdrawal Agreement is eventually approved (GBP +3-5%).

2) Article 50 deadline is extended (GBP+2-3%).

3) A second referendum (GBP +5%).

4) Article 50 is revoked, unilaterally by parliament or following a second referendum (GBP up 10%+).

On a broader perspective, the major downtrend of GBPJPY that went in the consolidation phase has now resumed bearish streaks again (refer monthly plotting) to retrace 78.6% Fibonacci levels (i.e. 131.415 levels by Q1 end), the current price trend has nudged below 7 & 21-EMAs.

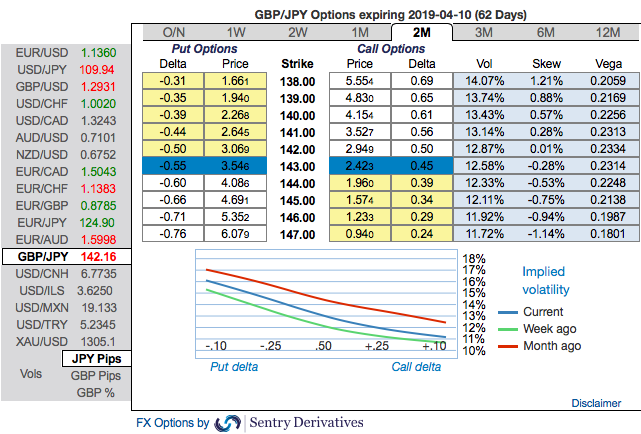

OTC Outlook and Hedging Strategy: Please be noted that IVs of GBPJPY display the highest number among entire G10 FX universe (trending between 14.07% - 11.72%). Hence, vega long put is most likely to perform decently capitalizing on the rising mode of IVs.

While the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes up to 138 levels which is in line with technical targets and bearish scenarios (refer above nutshells evidencing IV skews). Courtesy: Sentrix & JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -79 (which is bearish), while hourly JPY spot index was at 123 (bullish) while articulating (at 08:21 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data