The US-China trade developments remain very fluid and we are bound to see a few more adverse episodes.

The Cheap vega ownership could be deployed in anticipation of the vega tenors receiving more attention with the spot now under the watchful PBoC hand, we recommend using the favorable vol entry levels to add vega.

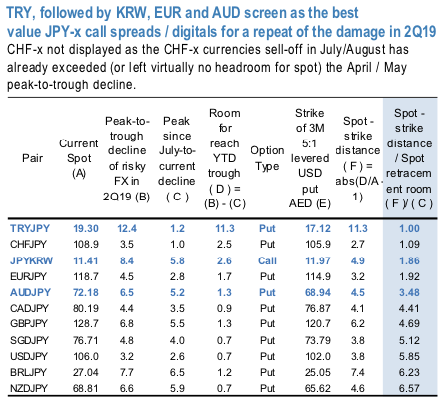

Risk-off digitals: Last week we looked into risk-off digitals for the USD pairs. Here we expand the analysis to crosses. 2nd chart ranks the currencies on a risk/reward metrics based on:

i) The available spot retracement room, and

ii) The spot-to-strike distance of a 3M 5:1 geared at expiry digital option in the direction of the anticipated spot moves. Digital options most closely mimic call and put spreads, which are frequently used by global macro investors to express directional views, but digitals come with the analytical advantage of a single strike and apples-to-apples comparability across pairs for an arbitrary ex-ante gearing.

The spot retracement room we estimate as the peak-to-trough sell-off of the underlying during April/May, less the decline from the local July peak to current levels already witnessed. Greater the headroom for spot relative to the threshold move required to deliver the maximum option payout, better value the option.

Turns out that the CHF-x currencies sell-off in July/August has already exceeded (or left virtually no headroom for spot) the April / May peak-to-trough decline thus we don’t include them in 1st chart which ranks the remaining JPY-x based on the risk/reward metrics.

On this metric, JPY/KRW and AUD/JPY call (put) spreads / digitals screen as the cleanest crosses to hedge against broad-based weakness.

While TRY/JPY tops the list by virtue of it having been much less reactive so far, which could change if lira’s monetary easing starts to weigh. Courtesy: JPM

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025