Sterling still edgy on geopolitical surface: Everyone is waiting for Boris Johnson to officially present his plans to avoid a hard border in Ireland to the EU, sentiment amongst British companies is increasingly deteriorating. The PMI for the manufacturing sector have surprisingly printed upbeat numbers in September, actual 48.3 versus consensus 47.0 and previous 47.4 level.

Admittedly, all those who are still hoping for an amicable agreement between the UK and the EU are not going to pay much heed to today’s data, as they are going to hope that the economy is going to pick up as soon as the Brexit uncertainty has been overcome. It is uncertain though to what extent the economy will pick up since the spring has been due to global weakness and to what extent it is the result of the uncertainty surrounding Brexit. The economic uncertainty thus remains far higher than many assume.

Recently, dovish voices from the ranks of the Bank of England have also been heard in this connection, speaking of the need for an interest rate cut even in the case of an orderly Brexit. This results in additional risks for Sterling quite apart from Brexit.

Hence, we extensively covered defensive Brexit trades over the last couple of months which remain relevant for the delayed deadline. More recently, the October Brexit uncertainty pricing dropped 5vols as risk from a no-deal crash out from the EU has faded. The economists take is that “It is doubtful that Johnson will cut a deal, the most likely of the PM’s options is resignation”.

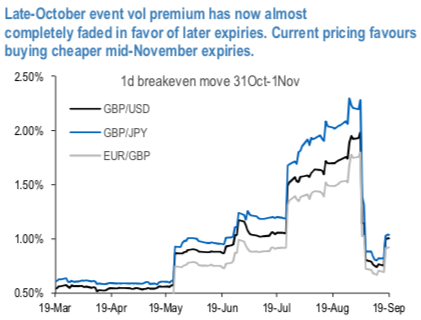

We see an opportunity in playing GBP knee jerk higher via delta-hedged OTM calls vol spreads, structured as long Gamma and short Vega with long 2M 25 delta call vols vs short 1Y OTM call vols. The 1st chart confirms that most of the event vol premium for the 31st October is by now gone, forcing a repricing higher of later expiries. Entering the calendar trade now allows a much cheaper entry point for buying Gamma, given the drop of the whole curve since late August peak levels.

March 2019 experience demonstrates strong uptake in P/L from the front tenor long OTM vols as spot rallied while vols held steady till the actual deadline delay (refer 2nd chart). We can see a similar dynamics playing out this time around as the risk of a general election keeps vols firm and a delay would provide a short term support for cable. One risk is that the spot rally has already played out and that there is very modest residual spot-vol correl P/L for 2M OTM calls to capture. 1Y expiry should be far enough, and topside vols isolated enough from firming in the vols around the new deadline.

Most importantly, the positively skewed implied volatilities of GBPUSD 3m tenors have still stretched towards OTM put strikes that indicates the hedging sentiments for the downside risks. To substantiate the downside risk sentiment, there is no change in risk reversal (RRs) numbers, RRs have also been signalling bearish hedging sentiments remain intact. Negative risk reversal numbers have been observed across all the tenors.

Hence, we add to the model portfolio: Buy 2M GBPUSD 25D call @11.85ch vs sell 1Y GBPUSD 25D call @9.0/9.6 indic, delta-hedged, equal notional. Courtesy: Sentry, Saxo, JPM & Commerzbank

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes