The currency market is in crisis mode. For EURUSD this means that usual factors such as interest rate differentials hardly count. These will only count again when the crisis is over. Then the euro could profit. While we have moved our GBP forecast path to weaker levels as a result of recent corona-related movements.

The massive spike in FX volatility in March has lifted VXY to 2-sigma rich for current macro settings, which may prove inadequate risk premium should growth conditions worsen towards 2008 extremes. A sustained cooling in realized vol is also a pre-requisite for a local peak in VXY; we are not there yet.

Severely inverted vol curves, especially in the front- end, offer an opportunity to own forward volatility as a positive carry long vol play, liquidity permitting. USDMXN and USDRUB synthetic FVA (aka gamma neutral calendars) screen as good front-end forward vol buys.

GBP vs safe haven FX correlations should fall amid GBP’s vulnerability to COVID-19 developments. We find value in defensive leveraged structures of the form (GBPUSD & USDJPY) that achieve premium savings by selling relatively high USD correlations.

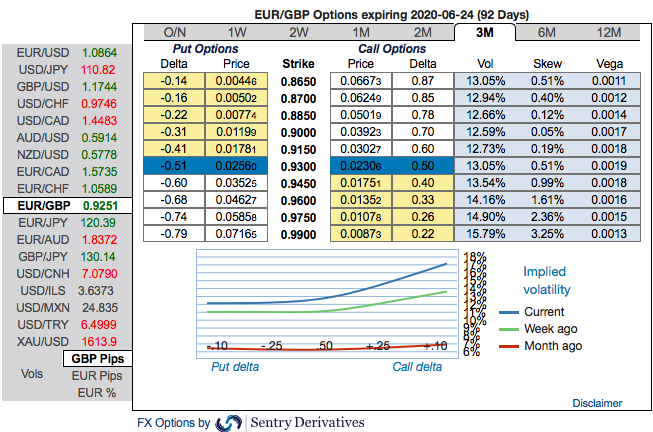

The positively skewed EURGBP IVs of 3m tenors are well-balanced, indicating both upside and downside risks, more bids are observed for OTM call strikes up to 0.99 levels.

While EURGBP risk reversals of the existing bullish setup remain intact as fresh bids for bullish risks have been added across all tenors.

According to the OTC FX surface, 3-way options straddle versus ITM puts seem to be the most suitable strategy for EURGBP amid the expected turbulent conditions contemplating some OTC sentiments and geopolitical aspects. Courtesy: JPM & Commerzbank

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different