Yesterday, Asia was poised for a muted open given the relatively calm price action in the G7 markets. This calm was decisively shattered as news filtered through that Iran launched a missile attack on an Iraq base hosting US troops. The tone shifted to risk-off and a dash to safety. Asian currencies sold off, JPY strengthened, and oil and gold rallied. A news agency report that President Trump could address the nation exacerbated the risk-off tone on fears that tensions will merely be dialed up. The White House subsequently said that President Trump will not address the nation and this provided a reprieve for the markets. It provided a breather for the markets on the perception of a measured response from the administration. However, this reprieve may be short-lived.

The price action in Asian currencies reflected this dynamics. For instance, USDKRW shot up over 1% towards 1,180 at the open but subsequently pared back gains to the 1,170 level. The twin deficit currencies in Asian remain the most vulnerable given the upside risks to oil prices, such as IDR and INR. For USDCNY, it opened without any fanfare and held steady around 6.9500. PBOC’s mid-point fix was set just a touch higher than our projection at 6.9450, suggesting adjustment from the central back. The stability in USDCNY is helping to mitigate the sell-off in other Asian currencies but this is also subject to change. On China, we are watching two main events near term, namely 1) the monthly data set for December due in the coming week and starting with inflation remained higher at 8%; and 2) details of the phase one trade deal ahead of the 15-January date for the two sides to sign the deal.

While the Indian rupee (INR) fell over 0.6% vs the USD last Friday to 71.80 in reaction to higher oil prices. It was the third weakest performance among Asian currencies last Friday, behind only the Korean won (KRW) and the Philippines peso (PHP). It is a stark reminder of the vulnerability of Asian currencies to higher oil prices given that Asia in general is a net oil importer.

Trade tips:

1) USD call calendar spreads: In addition to the above-stated geopolitical factors, the net positive theta profile of the calendar spread is consistent with our view, the run-up to the Phase I US/China trade deal is likely to be more reliably characterized by lower FX volatility than a full-throated embrace of carry trades, and allows us to better wear the long TWD/KRW cash position in the EM Asia portfolio that is bleeding negative carry at the current levels of FX implied yields.

On this basis, we advocate the following option structure: Off spot reference 1165.50, sell 3M 1200 strike USD call/KRW put one-touch option vs. buy 6M 1200 strike USD call/KRW put one-touch option, equal USD notionals for net 14% USD (individual legs 32.6% vs. 46.6% indic.). The net premium of 14% rolls up to 32.6% in 3-month time (2.3x carry gearing) if spot, forwards and vols were to remain unchanged.

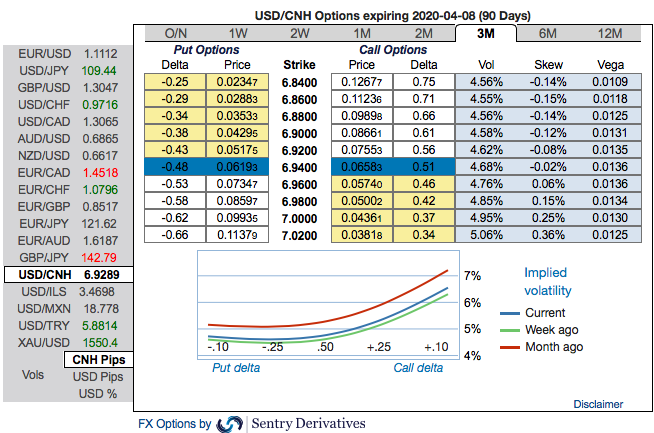

2) With USDCNY still in the broad for 7.05 – 7.10 range at any time, options markets are still bidding such upside risk possibilities. The positively skewed IVs of 3m tenors indicate that the upside risks of USDCNH are foreseen, bids for OTM calls upto 7.02 levels substantiate the bullish risks (refer above exhibit).

Hence, at this juncture, we uphold our shorts in CNH on hedging grounds via 5-month (7.00/7.15) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations. Courtesy: Sentry, JPM & Commerzbank

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays