This 22nd February, the latest round of BTCG19 CME futures (contract started on December 3rd2018) expires.

BTCUSD price has surpassed $4k mark today to extend bullish streaks and hit 6-weeks highs. The current price spikes above 7-DMAs with bullish crossovers and although we observe buying momentum, the same has been shrinking away ahead of expiry week.

The nature of futures contracts would imply that they need to be settled on a set, predefined date, based on a contract.

All CME contracts will have to be traded, or settled, before this date. There is generally a fall in the trading volume of futures around expiration dates, that coincides with a rise in volatility and potential short/long squeezing.

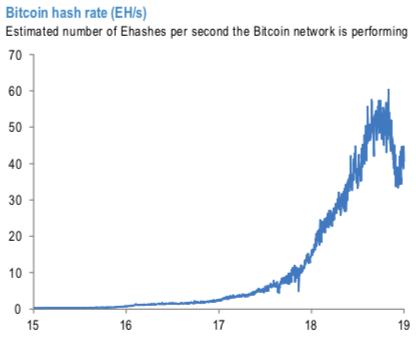

Following the declines in cryptocurrency values in November and early December, we noted the decline in Bitcoin mining activity as profitability collapsed, following a significant increase during 2018 boosted by improvements in technology. After a modest recovery in prices in the second half of December, mining activity recovered somewhat (refer above chart).

Currency Strength Index: FxWirePro's hourly BTC spot index is inching towards 40 levels (which is bullish), while hourly USD spot index was at 9 (neutral) while articulating (at 10:55 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges