USDCAD remains well cushioned testing fresh 18-month highs in the lower 1.35 region. As stated in our previous post, technical indicators signal broadly bullish trend continuation and intensified momentum nearing overbought thresholds. We continue to highlight the significance of the ascending channel from early October. The channel floor is now at 1.3370 and the ceiling is above 1.3580 levels. There are no major supply zone ahead of the upper 1.36 levels. We look to near-term support between 1.3420 and 1.3400 and look to near-term resistance between 1.3550 and 1.3580.

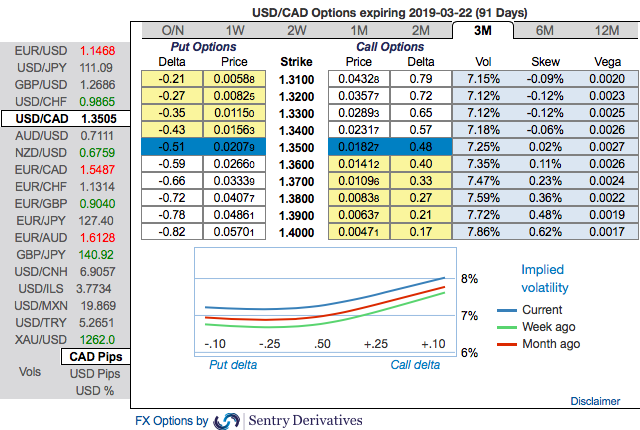

OTC updates: 3M ATM IVs are trading a shy above 7.15% - 7.86%, skews are also suggesting the odds on OTM call strikes upto 1.40 levels at this juncture. We could also notice bullish neutral risk reversals that signals upside risks in the risk-neutral distribution of returns. Also, the IV curve is at, or slightly decreasing, with maturity.

Favour optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Thus, call spreads are preferred option structures given elevated skew and favourable cost reduction.

At spot reference: 1.3508 levels, we execute USDCAD 3m/1m call spread with strikes of 1.32/1.40 for a net debit.

Maintain the net delta of the position above 40% and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25%.

Maximum gain is achievable when underlying spot FX move above OTM strike with ideal risk-reward.

By shorting the out-of-the-money call, the options trader finances the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. Source: Sentrix, saxobank

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -3 levels (which is absolutely neutral), hourly USD spot index was at -48 (bearish) while articulating at (08:40 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data