The CAD is soft, down modestly vs the USD while underperforming most of the G10 currencies as market participants focus on escalating diplomatic tensions between Canada and China.

The CAD’s standard drivers—oil prices (WTI) and yield spreads—are once again dominating following a period of uncorrelated movement through most of November. A reminder that the CAD also remains completely uncorrelated to the price of Western Canada Select.

Headwinds are strengthening as the price of WTI softens back toward the psychologically important $50/bbl level and yield spreads hover just below their recent highs.

The outlook for relative central bank policy is deteriorating as Fed tightening expectations recover while those for the Bank of Canada hold steady, with OIS only pricing about 20bpts of BoC tightening by May. CAD seasonals remain bearish, given the currency’s tendency to weaken into year end and base around the end of January.

The BoC will continue with its hiking cycle over the next two years, whereas the Fed will end its own cycle next year. Hence, we expect the CAD to appreciate.

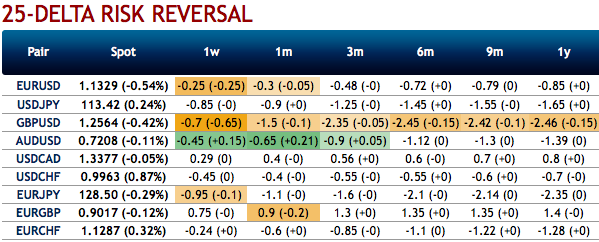

OTC indications and options strategies:

2M ATM IVs are trading a shy above 6.67% - 7.04%, skews are also suggesting the odds on OTM call strikes upto 1.36 levels at this juncture. We could also notice bullish neutral risk reversals that signals upside risks in the risk-neutral distribution of returns. Also, the IV curve is at, or slightly decreasing, with maturity.

Favour optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Thus, call spreads are preferred option structures given elevated skew and favourable cost reduction.

At spot reference: 1.3370 levels, we execute USDCAD 2m/1m call spread with strikes of 1.36/1.32 for a net debit.

Maintain the net delta of the position above 40% and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25%.

Maximum gain is achievable when underlying spot FX move above OTM strike with ideal risk-reward.

By shorting the out-of-the-money call, the options trader finances the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. Source: Sentrix, saxobank

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at 13 levels (which is mildly bullish), hourly USD spot index was at 51 (bullish) while articulating at (14:04 GMT).

For more details on the index, please refer below weblink:http://www.fxwirepro.com/currencyindex

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks