The Reserve Bank of Australia (RBA) left the official cash rate on hold at 1.50% as widely expected. Indeed, the RBA’s commentary today was remarkably similar to its statement in August. Market participants however, were looking for more cautious commentary, as suggested in a spike in the Australian dollar after the release. This comes with a backdrop of increasing uncertainty over the outlook, particularly for the global economy.

RBA Governor Lowe gives remarks later this evening at the RBA Board Dinner which typically involves a reflective and broad ranging speech.

Apparently, AUDUSD shows some sort of consolidation around 0.7200 ahead of the RBA decision this afternoon. A notable change, however was the recognition that the Australian dollar had “depreciated against the US dollar along with most other currencies”.

AUDUSD 1-3 month: The Aussie’s mid-August slide to 0.72 on Turkey-inspired global risk aversion left it quite oversold when judged by our short-term fair value estimate, which remains near 0.75. AU-US yield differentials have continued to drift in the US dollar’s favour in recent weeks but Australia’s key commodity prices have been mixed, overall a little higher since mid-August and a long way above March lows.

Still, AUD risks probably remain to the downside in September (0.70 handle), given the confluence of FOMC meeting, US review of China tariffs and EUR/Italy budget risks. By year-end we see AUDUSD back to 0.73.

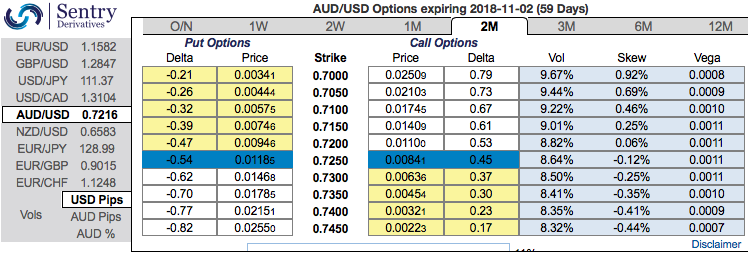

OTC outlook: Most importantly, please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.70 levels (above nutshell). While bearish delta risk reversal also substantiates that the hedging activities for the downside risks remain intact.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 34 levels (which is bullish), while hourly USD spot index was at 75 (bullish) while articulating (at 06:43 GMT). For more details on the index, please refer below weblink:

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge