We could foresee scope for depreciation for Israeli currency as limited from the current levels and in fact, we see increasing risks of USDILS trading higher. With ILS one of the strongest performers among EMEA EM YTD (+ 4% in spot terms vs USD), the BoI’s change in rhetoric with regards to their intervention policy will likely shackle shekel appreciation.

The fundamentals such as the BoP support to deteriorate again. However, for now, there is no strong driver to initiate ILS shorts, even as the balance of risks is shifting towards USDILS higher. Thus, sidelined sentiments are prevailing in FX avenue, but hold a 5y IRS receiver in rates. The BoI will likely limit further strength in the Shekel.

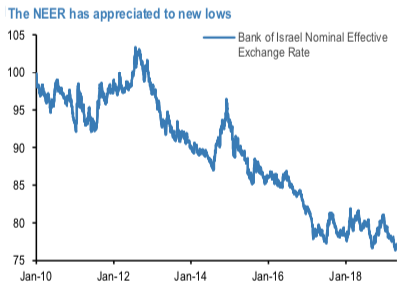

However, with the nominal effective exchange rate appreciating to record lows (refer 1st chart), the BoI has seemingly changed their rhetoric in the latest MPC minutes: "if the appreciation continues, the Bank of Israel will consider using the tool of intervention in the foreign exchange market". This indicates that any further shekel appreciation will likely be contained by a more proactive FX intervention policy.

While on the other hand, both CNY and CNH returned to the pre-G20 Finance Ministers and Central bank Governors Meeting level. President Donald Trump said that he personally held up a trade deal with China and an agreement is unlikely to be reached unless Beijing returns to the terms negotiated earlier. However, Trump’s rhetoric didn’t bring about too much impact onto the FX markets.

While lower institutional investor FX hedge ratios could also weigh on shekel. The direction of USDILS often tends to move in tandem with shifts in Israeli institutional investor behavior (refer 2nd chart).

The level of hedging behavior is likely driven in part by Israel’s carry differentials to the US dollar. With Israeli inflation contained and expected to drop to 0.9% yoy in May-19, way below the BoI's 1-3% target band, and the BoI sounding modestly dovish at its latest meeting. The analysts won’t see the next BoI hike until 2Q’20.

On the flip side, the US Federal Reserve is expected to remain on hold through to end 2020 too, and with the Fed recently pushing back against the idea of “insurance cuts”, we thus expect the carry differential to remain elevated for the foreseeable future (3rdchart).

This suggests that FX hedge ratios are likely to stay low and FX- unhedged foreign asset buying relatively high. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is creeping at 1 level (which is absolutely neutral), while articulating (at 13:22 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty