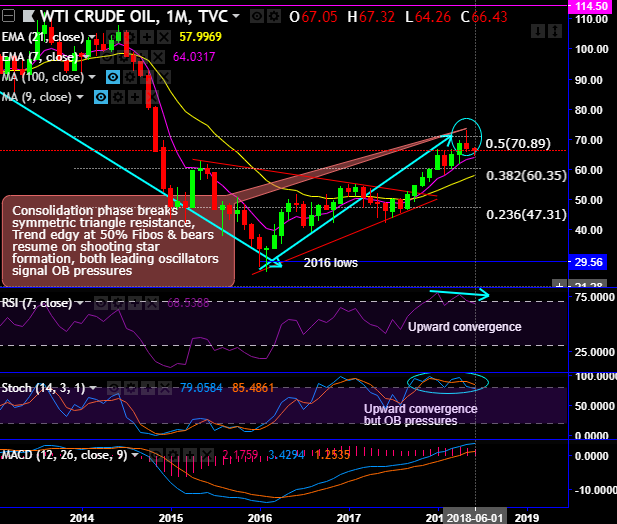

A technical glance at the underlying commodity: WTI crude bulls seem to be exhausted at 50% Fibonacci levels, as a result, shooting star has occurred at 67.03 levels but on the flip side, the consolidation phase appears to be intact on break-out above symmetric triangle (refer monthly chart).

Although you saw rallies from last three days, the bears resume at $66.51 levels with sharp dips on daily terms.

Prior to which, on the contrary, bulls test support at $65.85-$66.50 levels but these bull swings are not backed by both leading and lagging indicators.

The deep under-valuation of crude oil vols relative to demand and supply drivers has corrected to a large extent, but Brent M3 ATM vol is still 4-5 pts. too low. Coupled with a mixed outlook on realized volatility – potential noise from the June OPEC, seasonality of producer hedging flows, a weaker flat price environment in 2H’18 and USD spillovers, all offset to some extent by cleaner spec positions –this informs a neutral view on oil vol over the next month or two.

A meaningful change from 1H to 2H'18 could be that upside risks to prices and vol from a disruptive spike may moderate if OPEC carefully smooths production and additional shale supply comes to the market. Crude risk-reversals nonetheless discount an overly fat left tail due to ongoing producer hedging that is ripe for continued selling for alpha generation.

Heavy producer flows in May have also pushed the '19/'20 vol curve into steep backwardation. Open a short Brent Jun19 70 strike (30D) put vs long Jun20 ATMF straddle vega-neutral calendar spread to jointly fade skew richness and curve inversion. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics