There is a late swing in the Italian opinion polls in favour of MS5. While holding forecasts unchanged, we have established a decent long EUR position in the macro portfolio (vs JPY, NZD, and an EURUSD proxy).

The concerns about the Italian elections mount in 1Q’18 that poses bullish risks to the Swiss franc. While the election frontrunner Matteo Salvini said his party is ready to withdraw from the European Union and the Eurozone unless Brussels stops "victimizing" Italy with harsh economic demands.

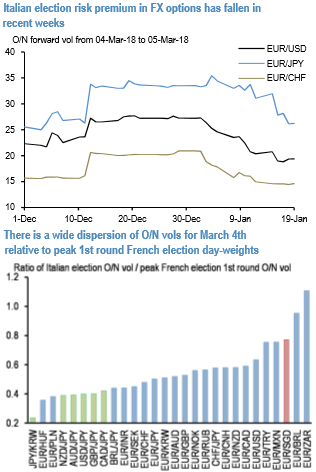

Italian election risk premia have continued to slide this year (refer above diagram), and yen-crosses, in particular, have been the largest casualties of the re-pricing.

At current levels, 4th March O/N vol levels in JPYKRW (8.7), AUDJPY (14.2), USDJPY (11.1), GBPJPY (13.7) and CADJPY (13.7) all look unthreatening, especially when compared to the frenzy of the French election episode (refer above diagram).

On average, options markets are priced at 50% of the event premium of the 1st round of the French vote from last year which is perhaps fair on the whole, but there is significant dispersion across currencies that creates the potential for relative value:

JPY crosses are at the cheap end of the spectrum with an average French election O/N multiple of 0.4.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis