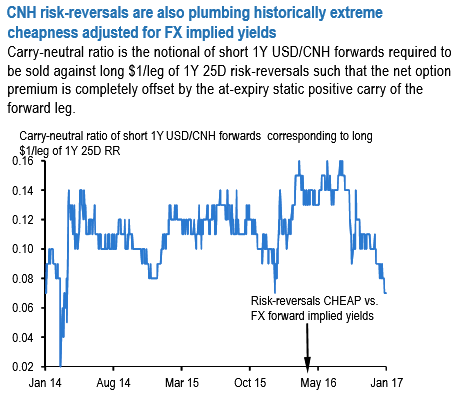

The cheapness of CNH risk-reversals relative to implied yields is also plumbing a historical extreme (refer above chart), as gauged by the carry-neutralizing forward delta-hedge ratio (the notional of short USDCNH forward partial delta-hedge needed to be combined with long unit notional/leg of a risk-reversal such that the option premium is completely paid for / offset by the static carry on the forward leg).

As difficult as it is to stomach during a week of pain on dollar longs, the risk reversal set-up suggests that a carry efficient way of resetting medium-term short China positions is to buy USDCNH risk-reversals hedged with a tiny amount of short forwards.

The chart above shows that this carry neutralizing forward notional is only 0.07 for a 1Y 25D riskie at current market, suggesting that a package of (long $100mln/leg of 1Y 25D RR + short $7mn of 1Y forward) yields $43mn (=$50mn of BS delta from the option –$7mn of the forward) of carry-free delta, which is a luxury in an environment of 6% + negative carry in forwards.

What about CNY vol itself? There is a case to be made that elevated carry/vol makes owning USDCNH straddles appealing as static carry on the USD put leg of the straddle stands to recoup more than 90% of option premium in unchanged markets. The fly in the ointment is that realized vols (excluding this week’s) have consistently clocked 3% 4% below ATMs for most of the past year, and vega profits have only accrued during periods of heavy directional demand for USD calls. The latter will perhaps only return after the current position squeeze has run its course, so we reckon better risk-reward for longs will emerge at or below 7.0 on 1Y ATM vol.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data