Norges Bank was the main event of focus in the recent past. The central bank of Norway left its key policy rate steady at 0.75 percent on January 24th2019, which is in line with market consensus. Policymakers said that the outlook and the balance of risks imply a gradual increase in the policy rate. Global growth is a little weaker than projected, and there continues to be considerable uncertainty surrounding developments ahead. In Norway, economic growth and labor market developments appear to be broadly as projected, while inflation has been slightly higher than expected. The central bank reinforced the policy rate would most likely be raised in March 2019.

The outcome was largely in line with our expectations their outlook on the economy is little changed since December and they continue to expect that a hike will occur in March, consistent with the baseline. The fly in the ointment was that the bank pointed to considerable uncertainty around the global outlook, but this was not unexpected given soft regional growth and ongoing trade conflict.

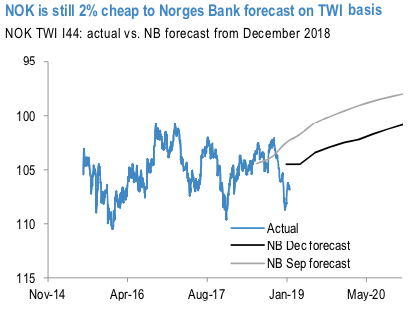

There are still two months between now and the March meeting (March 21) for the central bank to assess the impact of global uncertainties. Without improvement, it would be reasonable to expect a dovish hike (i.e. with a flatter trajectory for future hikes), but with the currency still 2% cheap relative to NB forecast, we continue to find value in long NOK trades (refer above chart).

NOK longs are expressed tactically vs SEK given that we expect the Norges Bank to be the next Scandi central bank to be in play (next rate hike from NB is expected to be in March, while the next one from the Riksbank is slated for 2.

Bought NOK/SEK outright in early January at around 1.0334 levels. Stop at 1.01. Marked at + 2.80%. Courtesy: JPM & Tradingeconomics

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -22 levels (which is mildly bearish), hourly USD spot index was at 32 (bullish) while articulating at (13:54 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch