Of late, MXN seemed to be extending recovery threatening upper bound of recent range.

But the previous massive sell-off of Mexican peso caused a vol surface dislocation, nudging skews to the highest since the 2016 US Presidential elections. Delta hedged 1*1.5 ratio call spreads exploit the dislocation while also having historically offered a superb performance. +1Y/-3M calendars of risk reversals take advantage of the lagging back-end vs front-end implied skews.

The structure would benefit from a quiet(ish) price action on MXN, with the spot preferably drifting higher or at least remaining around current levels. While the current richness of the riskies is helping to tilt the risk-reward favourably, a few notable risks remain. Namely, selling topside calls exposes the seller to negative impact from realizing spot-vol correlation in the event of a sell-off, while better sentiment could expose the long downside (ATMF) call leg to softer realized vols on lower spot levels. Note that realized spot-vol correlation is performing; however, the trailing nature (3m rolling window) of the realized measure (compared to the forward looking implied measure) makes it less relevant for forecasting future performance. In order to mitigate the risk from spot-vol correlation continuing to perform, 6M or longer maturities could be good candidates for implementing the trade, offering the opportunity of closing then once a given P&L target on lower implied skews has been reached.

With the above in mind, we take the opportunity to analyse what generally works on the MXN vol surface, on a back-tested basis and from a pure vol standpoint. 2nd chart analyses a variety of structures, all for 6M maturities. For instance, selling RRs (delta-hedged) works orders of magnitude better than selling ATM vol (refer 2nd chart - bottom, Sharpe Ratio of 0.87 vs. 0.15 over past 5-yrs). Better yet, 1*1.5 ratio USDMXN call spreads (delta-hedged) have been notably a high Sharpe Ratio (1.66) trade to hold over the years. Being long ATM vs. short OTM calls at near vega neutral notionals, the 1*1.5 ratio call spread structure is also well positioned to be selling topside OTM vols, which now are priced heftily after the latest vol explosion.

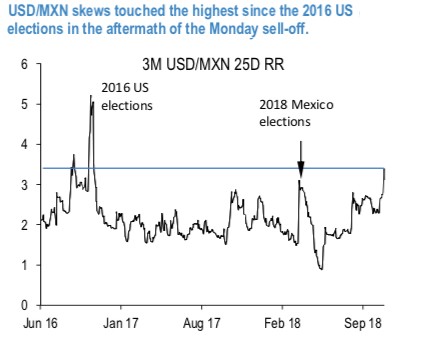

The peso sell-off triggered a vol surface dislocation, pushing gamma vols to 15.3 handle, the highest since June, and an even quicker reaction of front-end skews, reaching the highest since the 2016 US Presidential elections (refer 1st chart). The back of the vol curve is lagging the move, with 12M / 3M 25D risk reversals vol ratio at a multi month low. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at 0 (which is absolutely neutral), while articulating at (10:08 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures