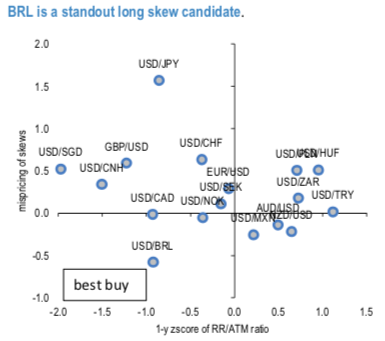

BRL has been one consistent standout currency on the above carry-vol metrics for assessing cheapness of skews. That’s further supported in 1stchart where BRL is the only USD pair that checks all the boxes. Sentiment toward BRL has been largely supportive and our Latam analysts continue to see it as a buy. That is not necessarily negative as grind lower in USDBRL is likely to lead to softer realized vol which would be supportive of the short USDBRL put leg.

Moreover, following the latest rebound in static carry (total return from delta-hedged 3M USDBRL 25D risk reversal, assuming unchanged markets – 2ndchart), delta- hedging now again pays for the skew decay. In other words, this offers the opportunity of entering a long convexity trade for higher USDBRL and receiving a positive, albeit tiny, time decay for doing so. As we can see from the bottom chart, the actual performance of the long USDBRL risk- reversal construct has been well explained by the static, or ex-ante proxy of, carry.

We recommended buying a 3M USDBRL 25 delta risk-reversal, delta-hedged, @ 1.8/2.15 vols, at spot ref. 3.7594 levels. We would like to uphold the same strategy going forward.

Another possibility would involve favouring the box risk- reversal implementation, by shorting the 3M USDBRL 25-delta put and buying the 6M USDBRL 25-delta call. The flattish term structure in the 3M-6M segment, and the possibility of earning a higher Carry due to the higher Gamma embedded in the short leg could favour this latter implementation, as we had pursued last week on a similar structure on USDMXN. Courtesy: JPM

Currency Strength Index:FxWirePro's hourly USD spot index is inching towards -24 levels (which is mildly bearish), while articulating (at 13:28 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise