Around a fortnight ago, we had anticipated bearish calls accentuating on whipsaws resistance at 0.9955 and break below of channel support, now see the evidence of their bearish effects.

Please refer below link for our previous analysis on this AUDCAD.

https://www.tradingview.com/chart/AUDCAD/pr2yQNzK-AUD-CAD-whipsaws-on-DMA-push-southwards-channel-acts-as-support/

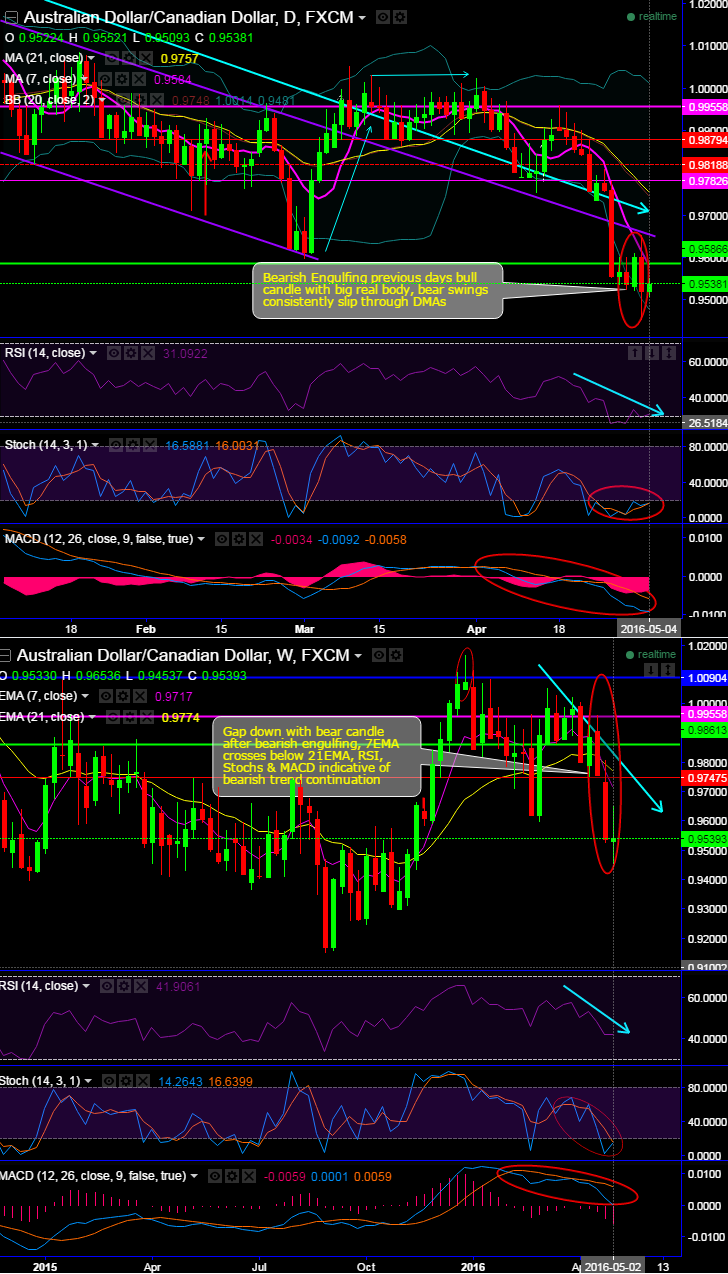

In March month, it has completely shown whipsaws on DMAs and on resistance at 0.9955 levels (see daily chart).

Their bearish effects have now been seen considering previous rallies.

Bearish engulfing (at 0.9522) previous day’s bull candle with big real body, bear swings consistently slip through DMAs.

Gap down with bear candle after bearish engulfing, 7EMA crosses below 21EMA, RSI, Stochs & MACD indicative of bearish trend continuation.

RSI forming lower lows consistently on both daily as well as weekly charts that is indicative of losing strength in current price levels.

While, MACD's bearish crossover has just entered into zeros (which is bearish trajectory) and current prices sliding below DMA & EMAs are suggestive of bear trend continuation.

7DMA & EMAs cross below 21 DMA & EMAs respectively which is a sell signal.

Intraday sentiments have been slightly recovering, while traders on delivery basis should focus on rallies for fresh shorts as the downswings likely prolong if it doesn't hold firmly at current levels and channel resistance.

Trade tips: Well, on speculative grounds, we recommend buying boundary binary options in order not to derive maximum leverage on this bearish anticipation but certain yields from this minor upswings but favoring robust bear trend in long term by choosing OTM call strikes at 0.9552 (15-20 pips above) and ITM call strikes at 0.9509 (around 25 pips below).

Wider spreads indicates lack of liquidity. Anywhere between above range is barrier level, and the spreads for one touch AUD/CAD binary options with extremely shorter tenor would fetch in certain yields and the thereby returns of about 30-35 pips is quite possible.