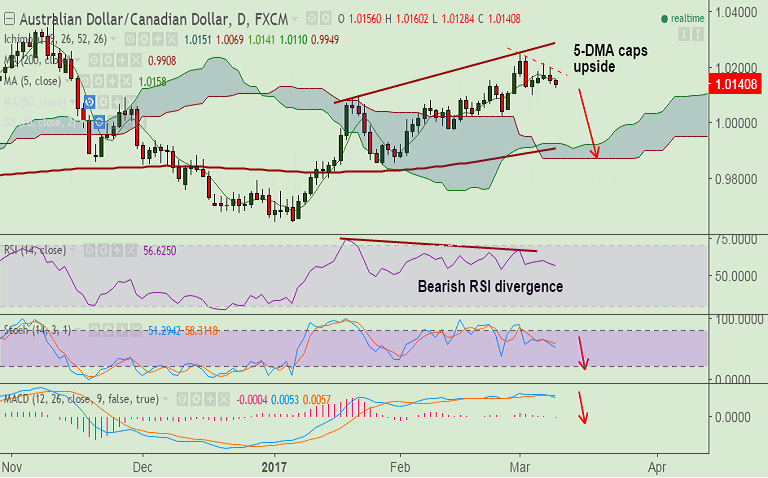

- AUD/CAD trades a narrow range, capped below 5-DMA, intraday bias lower.

- Bearish divergence on RSI builds scope for downside in the pair.

- Stochs are also biased lower and MACD line is showing a bearish crossover on signal line.

- Downside likely to test 100-DMA at 0.9983. Bearish invalidation only above trendline resistance at 1.0185.

- Violation at 100-DMA finds next major support at daily cloud by 0.9925.

Support levels - 1.010 (20-DMA and 23.6% Fib retrace of 0.96439 to 1.02537 rally), 1.00 (38.2% Fib and Feb 24 low), 0.9983 (100-DMA)

Resistance levels - 1.0158 (5-DMA), 1.0185 (trendline), 1.0215 (Mar 7 high)

TIME TREND INDEX OB/OS INDEX

1H Neutral Neutral

4H Neutral Neutral

1D Neutral Neutral

1W Bullish Neutral

Recommendation: Good to go short on break below 20-DMA at 1.010, SL: 1.0158, TP: 1.00/ 0.9985

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -128.949(Highly Bearish), while Hourly CAD Spot Index was at 6.13666 (Neutral) at 0910 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.