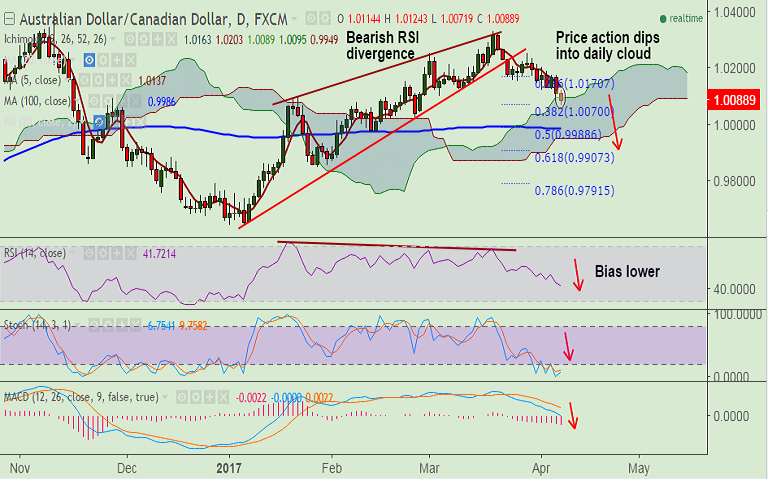

- AUD/CAD price action dips into daily cloud, scope for downside.

- The pair is extending declines along 5-DMA, on track to test 100-DMA at 0.9986.

- Technical studies point to further downside, we see no signs of reversal.

- Bearish RSI divergence adds downside bias, bearish invalidation only on close above 5-DMA at 1.0137.

- Downside is now holding support at 38.2% Fib retrace of 0.9644 to 1.0333 rally) at 1.0070.

- Break below will see next major support at 100-DMA at 0.9986.

Support levels - 1.0070 (38.2% Fib), 1.0022 (Feb 24 low), 0.9986 (100-DMA)

Resistance levels - 1.0137 (5-DMA), 1.0170 (23.6% Fib), 1.0199 (20-DMA)

TIME TREND INDEX OB/OS INDEX

1H Neutral Neutral

4H Neutral Neutral

1D Bearish Neutral

1W Bearish Neutral

Call update: Our previous call (http://www.econotimes.com/FxWirePro-AUD-CAD-breaks-major-trendline-support-at-10225-good-to-short-rallies-605391) has hit all targets.

Recommendation: Good to go short on rallies around 1.010, SL: 1.0140, TP: 1.0070/ 0.9985

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -97.2884(Bearish), while Hourly CAD Spot Index was at 54.8037 (Neutral) at 1140 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.