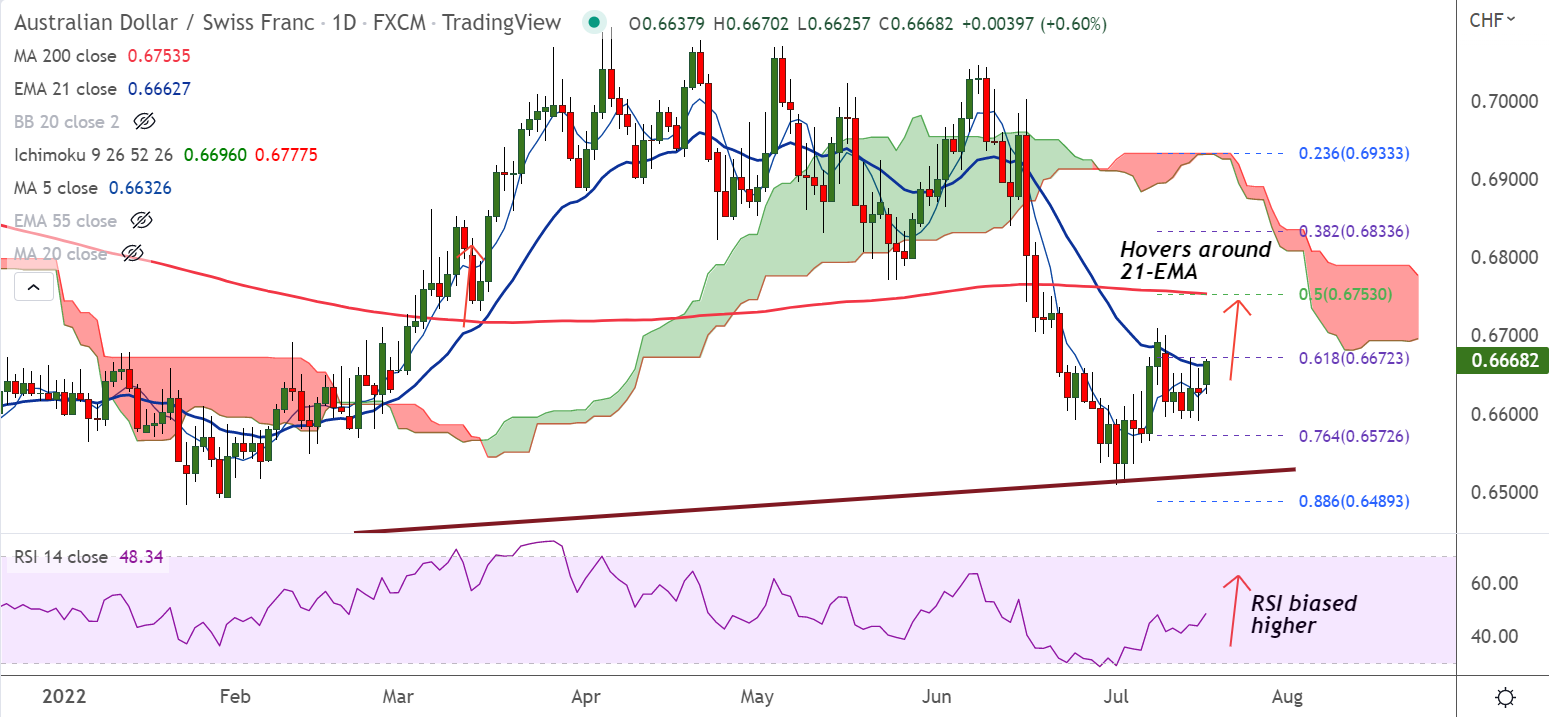

Chart - Courtesy Trading View

Technical Analysis:

- AUD/CHF was trading 0.59% higher on the day at 0.6667 at around 15:00 GMT

- The pair has ignored previous session's Doji formation and edged higher

- Price action is testing 21-EMA resistance and decisive break above will fuel further gains

- Momentum is bullish, Stochs and RSI are biased higher, Chikou span is biased higher

- Price action is above 200H MA and GMMA indicator shows major and minor trend are bullish on the intraday charts

Support levels:

S1: 0.6635 (200H MA)

S2: 0.6622 (20-DMA)

Resistance levels:

R1: 0.6672 (61.8% Fib)

R2: 0.6749 (55-EMA)

Summary: AUD/CHF is hovering around 21-EMA, watch out for decisive break above for further upside.