This week’s Australian CPI result was a significant surprise, with core inflation dropping to a 3 year low, alongside broad weakness in services pricing. We have been expecting the RBA to cut in July and August, motivated mostly by concerns about the activity data. But with inflation now drifting even further off track, we have brought this forward to cuts in May and June (25bp each), on the grounds that the Bank will be unable to defend a SoMP forecast set showing a return to the target without immediate policy action.

AUDUSD has been weakening since mid-month, and got a kick along from the CPI result, but has proven relatively sticky at the lower end of the six-month range, particularly in the context of fairly likely near-term easing (May OIS is currently priced at 50% for a cut). The market’s reluctance to embrace deeper downside in AUD partly reflects the background support from high commodity prices, and particularly, evidence of an upturn in China.

This was confirmed by the trimming of AUD shorts in last week’s IMM report, which coincided with stronger Chinese growth and IP data.

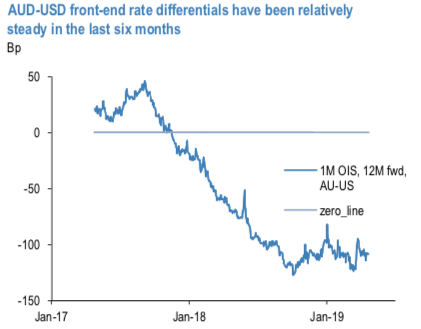

Still, in the absence of a broader Asia-wide recovery in the industry, further upside to Australia’s terms of trade is limited. And with rate differentials now finally starting to break the range (the move so far this year has only been a catch-up to the Fed), the beta to further incremental interest rate changes from the RBA is likely to be greater.

Relative AUD-USD policy expectations (12M fwd 1M OIS) have been range-bound at around -110bp over the last six months (refer above chart), having trended down by 170bp over the prior year. Alongside the resilience in iron ore prices, the recent sideways drift in rate spreads helps account for the stability of AUD since late 2018. Through the 2018 decline, AUDUSD had a beta of about 0.06 to AU-US rate differentials (% per bp).

Extension of this bout of RBA re-pricing is likely to take the form of a deeper market reassessment of the terminal rate, which has started pushing sub-1%. We are forecasting AUDUSD to 0.68 at mid-year. Given the partial beta mentioned above, and our Fed view, this AUD forecast would be consistent with an RBA terminal rate of 0.65%.

Trade tips:

Our largest exposures are short antipodes. We increase the beta ahead of potentially landmark policy decisions from the RBA and RBNZ in May, this time through an AUDJPY put part funded by selling a USDJPY put USDJPY implieds may be close to record lows but the risk premia are nevertheless high.

Buy a 6w 76.75 AUDJPY put, sell a 6w 1110 USDJPY put.

Buy USDINR 1Y ATM straddles vs sell AUDUSD 1Y straddles. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -79 levels (which is bearish), while hourly USD spot index was at 50 (bullish), and JPY is at 67 (which is bullish) while articulating (at 09:02 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan