- Renewed bid-wave in the Aussie as markets continue to digest strong business confidence data out of Australia pushed AUD/JPY above 83 handle.

- Data released earlier today showed Australia business conditions index jumped 5 points, to +14 index points, its highest level since the Global Financial Crisis.

- Business confidence, however, fell 1 point, below the peaks of recent years to 6 points.

- AUD/JPY fails to hold gains, slips lower to currently trade at 82.92 levels.

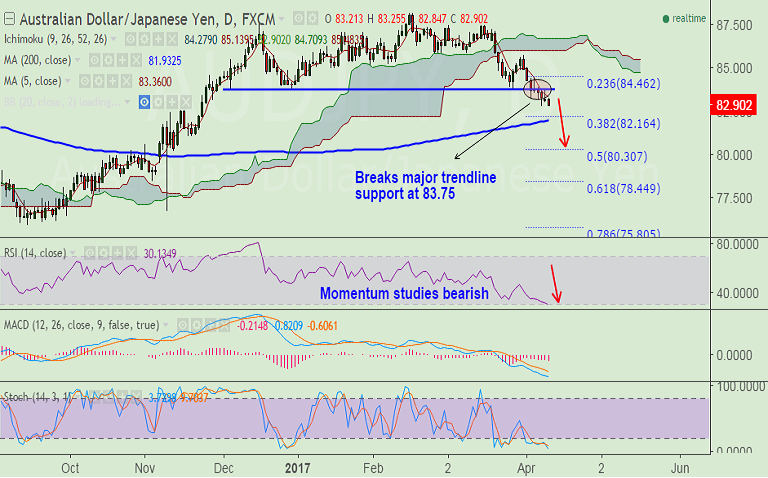

- Momentum studies bearish after the pair broke major trendline support at 83.75.

- Pair on track to test 200-DMA at 81.93, bearish invalidation only on close above trendline support turned resistance at 83.75.

- Support levels - 82.16 (38.2% Fib retrace of 72.43 to 88.17 rally), 81.93 (200-DMA), 81.11 (Nov 17&18 low)

- Resistance levels - 83.36 (5-DMA), 83.75 (trendline), 84, 84.46 (23.6% Fib)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-AUD-JPY-breaks-major-trendline-support-at-8375-eyes-200-DMA-stay-short-625055) is progressing well. TP1 hit.

Recommendation: Momentum remains bearish. Stay short for targets.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -71.6868 (Bearish), while Hourly JPY Spot Index was at 140.124 (Bullish) at 0715 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.