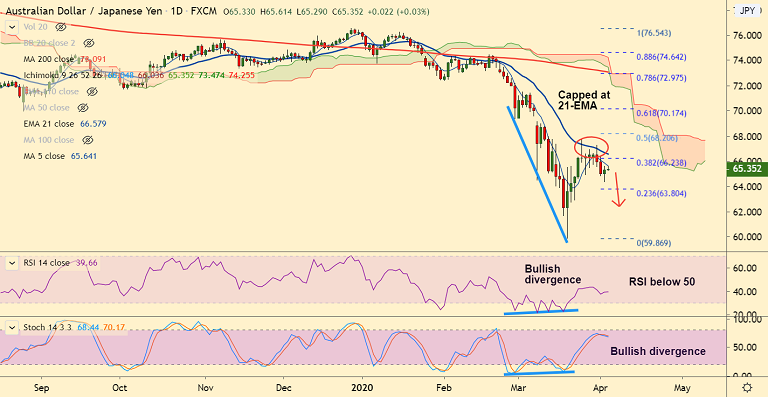

AUD/JPY chart - Trading View

AUD/JPY was trading largely unchanged at 65.35 at around 07:35 GMT, slipping lower from session highs at 65.61.

The pair was capped at 5-DMA resistance at 65.64, scope for downside resumption.

The Aussie dollar fails to benefit from above-forecast Aussie retail sales data and a rebound in the Chinese Caixin Services PMI.

Lingering concerns over the Japanese outbreak of COVID-19 would potentially jeopardise the yen's safe-haven allure.

Also, Moody’s on Friday, said it expects Japan’s GDP to contract by 2.4% in 2020, which will have knock-on effects on the job market.

Major trend in the pair is bearish. Price action has been rejected at 21-EMA and has edged below 200H MA.

Dip till lower Bollinger band at 62.811 likely. Breakout at 21-EMA negates bearish bias.

Support levels - 63.80 (23.6% Fib), 62.81 (Lower BB)

Resistance levels - 65.64 (5-DMA), 66.58 (21-EMA)

Guidance: Good to go short on upticks around 65.60, SL: 66.60, TP:65/ 64

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty