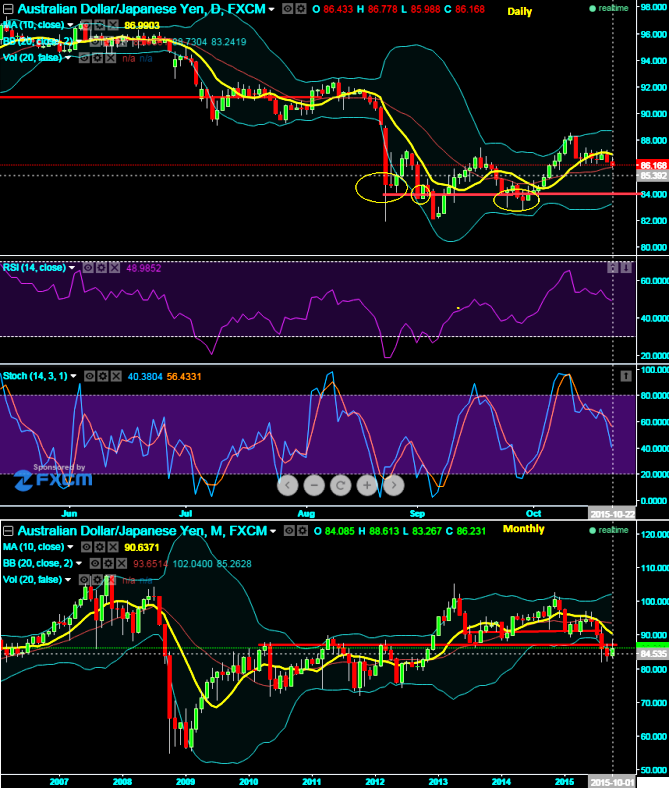

We were bearish on this APAC pair and shared our stance accordingly in our last week's post, you can now figure out from the daily chart that the yellow circled areas served as the strong demand and supply levels for this pair couple of times in the past as well. The next crucial support is only at around 84.576 region on daily chart.

The pair has failed to hold onto the crucial resistance at around 87.069 levels which we already stated earlier that it was unable to breach that level, as a result more weakness is seen in this pair at current level.

EOD graphs suggest bearish signals, the pair has currently fallen below 10DMA and headed towards south.

More importantly, leading oscillators like RSI and slow stochastic curves began showing convergence with the previous downswings; we believe this as bears are getting active. RSI is currently trending at around 48.8238 that has started showing downward convergence to the price dips above 70 levels which is overbought zone.

In addition to that %D crossover on stochastic curve has maintaining above 80 which is signifying again more retracement is likely and it gives us one more reliable indication that the pair is likely to find above mentioned support level.

Thus, as it failed to hold the above stated resistance level, it would determine the next downward direction of trend.

FxWirePro: AUD/JPY likely to slide further, next crucial support at 84.576

Thursday, October 22, 2015 6:34 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?