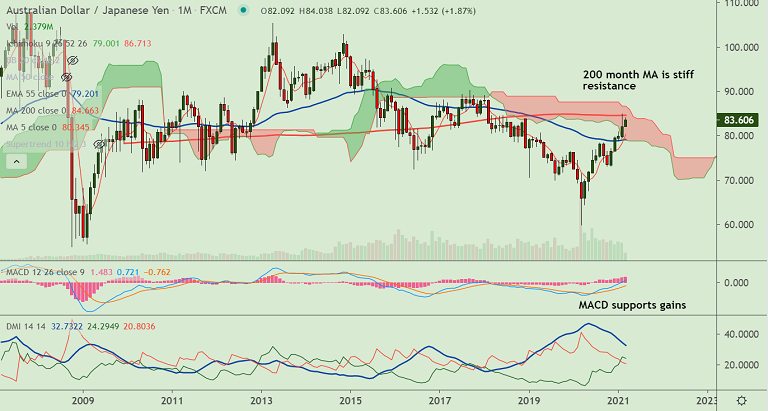

AUD/JPY chart - Trading View

AUD/JPY was trading 0.55% higher on the day at 83.69 at around 05:50 GMT, bias neutral.

The pair is trading in familiar ranges, extends sideways grind along 200H moving average.

Price failed to break above 200 month moving average resistance last month, decisive break above required for upside continuation.

Data released earlier today showed NAB’s February Business Conditions and Business Confidence both edged higher to 15 and 16 from prior figures of 7 and 10 respectively.

Further risk-on boosted after US 10-year Treasury yields fell, snapping the four-day winning streak. Also S&P 500 Futures print 0.67% intraday gains to 3,845.

Major trend in the pair is bullish. Price action is on track to test 200 month MA at 84.66. Watch out for decisive break above for upside continuation.