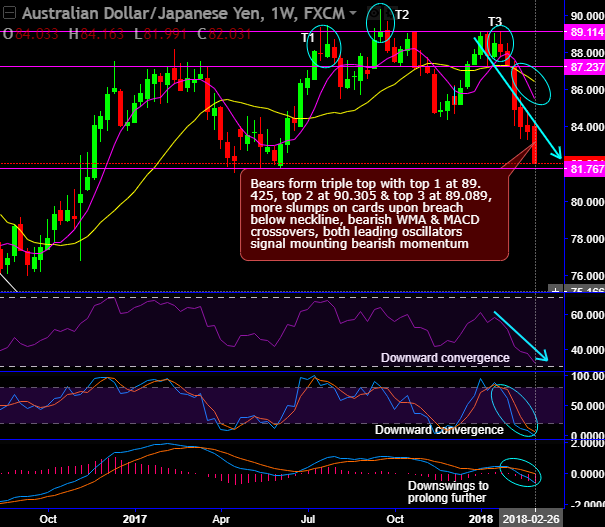

Bears form triple top with top 1 at 89.425, top 2 at 90.305, top 3 at 89.089, and neckline at 84.397 (refer weekly plotting).

For now, more slumps seem to be on cards upon breach below the neckline, bearish WMA & MACD crossovers, while both leading oscillators signal mounting bearish momentum.

Well, AUDJPY major trend that was in the consolidation phase from the lows of 72.437 since June 2016 retraced almost more than 50% Fibonacci level. But for now, the bears repeat the history near stiff resistance levels of 90.254.

Shooting star patterns have occurred at 88.401, 89.116, and 88.061 on the weekly chart, 88.097 on monthly terms to signals weakness on failure swings at this stiff resistance of 90.254 levels.

On monthly terms, gravestone doji has occurred followed by the bearish engulfing pattern at 87.937 and 82.783 levels respectively.

As a result, the current price has gone below WMAs and EMAs on weekly and monthly terms respectively.

Momentum in the prevailing downtrend on both terms is intensified as both RSI and stochastic curves are converging to the price dips, strength is faded away in the previous rallies.

To substantiate this bearish stance, bearish MACD and DMA crossovers indicate that the downtrend continuation in the days to come.

Trade Tips:

Contemplating above stated technical reasoning, on speculative grounds we advise buying tunnel spread options strategy, using upper strikes at 83.270 and lower strikes at 81.767 levels.

As long as underlying spot FX keeps dipping, the strategy is likely to derive exponential yields than the spot movements.

Alternatively, shorting mid-month futures contract are also advocated with a view to arresting downside risks.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -21 levels (bearish), while hourly JPY spot index was at 28 (bullish) while articulating at 09:41 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: