Briefing about FX performance and central banks:

This week, Aussie dollar against Kiwi dollar has been gaining vigorously (about 1.21% while articulating) as both technical and fundamental indicators are still signalling buying sentiments.

In the speech of RBNZ Assistant Governor John McDermott did not contain any guidance for markets on upcoming OCR decisions.

The RBNZ also used the speech to highlight that they constantly review their forecasting process to ensure it provides a solid basis for decision making (the RBNZ is typically viewed as one of the most reliable forecasters of NZ economic conditions).

On this front, the RBNZ highlighted that inflation has been lower than they had expected, and they continue to examine the reasons for this. This was a repeat of comments they had previously made.

OTC FX Outlook:

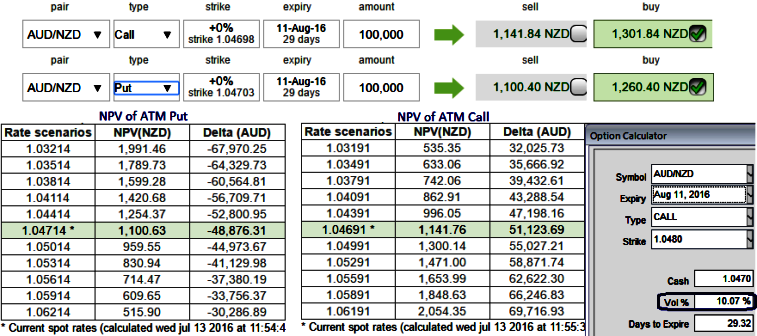

ATM IVs of 1m expiries are at 10.07% and the premiums of these ATM call strikes are trading at 14% and ATM put premiums 14.5% which is reasonable considering the on-going upswings that we made a mention about underlying spot prices.

If you’ve to compare the prevailing ATM IVs with the swings on the monthly technical chart, the on-going bullish swings may be having the same momentum in rallies as we are seeing it right now, so, technically, we could see the same ease of upswings until it tests stiff resistance at 1.1290 and 1.1416 levels.

If IV is high, it means the market thinks the price has a potential for large movement in either direction. Low IV implies the market thinks the price will not move much and so that it is beneficial for option writers.

Thus, the current rallies can effectively be utilized as any resultant effects of RBNZ's surprising rate cuts may also add impetus in the rallies of this pair.

Hence, we recommend initiating longs in 1M ATM +0.51 delta call, 1 lot of (1%) OTM call and simultaneously go long in 1 lot of ATM put as well on the hedging grounds.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch