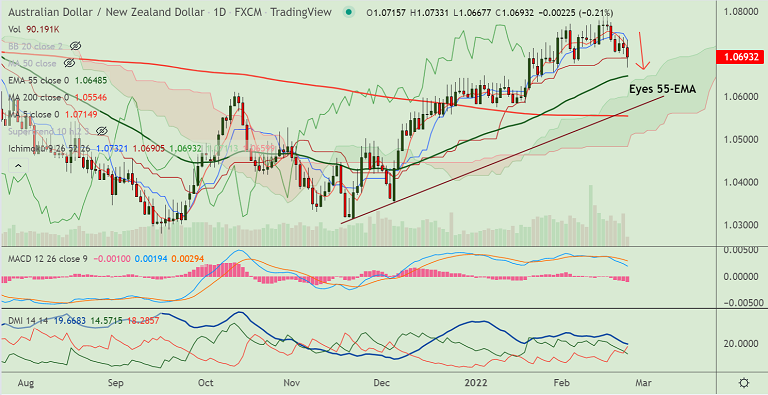

Chart - Courtesy Trading View

Spot Analysis:

AUD/NZD was trading 0.25% lower on the day at 1.0688 at around 09:00 GMT

Previous Week's High/ Low: 1.0738/ 1.0700

Previous Session's High/ Low: 1.0796/ 1.0703

Fundamental Overview:

RBNZ lifts interest rate by 0.25%, its third consecutive rate hike on early Wednesday as widely expected and signaled a more aggressive tightening path going forward.

The central bank projected that the cash rate would reach 2.2% by the end of 2022 and 3.35% in the last quarter of 2023, 0.75% higher than its November forecast of 2.6%.

Australia Q4 Wage Price Index printed at +0.7% quarter on quarter, inline with expectations, while year on year, it was 2.3% vs 2.4% expected.

Following the data, the odds of a Reserve Bank od Australia rate hike in June dropped below 50%.

Technical Analysis:

- AUD/NZD is struggling to hold break above weekly cloud

- Chikou span is biased lower, MACD and ADX support downside

- Price action has broken below 21-EMA and is on track to test 55-EMA

- Momentum has turned bearish, Stochs and RSI are biased lower

Major Support and Resistance Levels:

Support - 1.0648 (55-EMA), Resistance - 1.0712 (21-EMA)

Summary: AUD/NZD trades with a bearish bias. Dip till 55-EMA at 1.0648 likely.