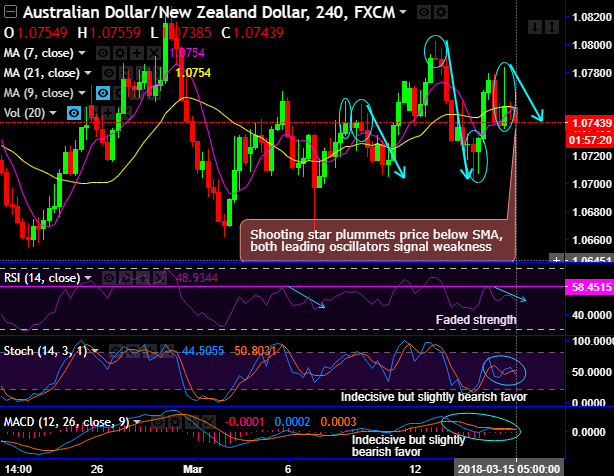

Chart pattern formed: The trend moves in the range bounded pattern on major trend and shooting star occurs at the minor trend (refer both 4H and monthly chart).

As a result of the bearish pattern occurred at 1.0755 levels, the current prices slide below SMAs again.

Prior to which gravestone doji and shooting star patterns were formed at 1.0789 and 1.0743 levels respectively (refer 4H plotting) and shown their bearish effects.

Steep slumps are witnessed soon after bearish engulfing at 1.0744 levels, as the current prices have slid below SMAs, expect more dips on bearish convergence signaled by momentum oscillators.

For now, AUDNZD bearishness is backed by both leading & lagging oscillators on this timeframe.

The major trend of this pair has been downtrend that has gone into consolidation phase approximately from the last three years or so.

For now, in a neutral state near term, a 1.0700-1.0800 range likely to contain.

Whereas in the medium term perspectives, during the next month there’s potential for a further decline below 1.07, given recent interest rate and commodity movements have slightly favored the NZD.

Upon failure swings near range resistance, trend back in range, expect the range bounded trend to persist as momentum indicators signal losing strength, current prices slid below EMAs.

Overall, as stated before the resumption of the major downtrend is very well visible, even if you witness any abrupt upswings, that shouldn’t be deemed as panicky buying sentiment.

Instead, tunnel spreads binary options strategy is advocated for the intraday speculative trades for bearish targets, use upper strikes at 1.0757 and lower strikes at 1.0705 levels.

Alternatively, deploy short hedge using futures contracts of mid-month tenors with a view to arresting bearish risks below 1.07 levels.

These are the conviction trade and it is wise to jack up speculative leveraged positions in order to fetch exponential yields than the spot moves.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at -74 levels (which is bearish), while hourly NZD spot index was at shy above -4 (neutral) while articulating (at 07:18 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: