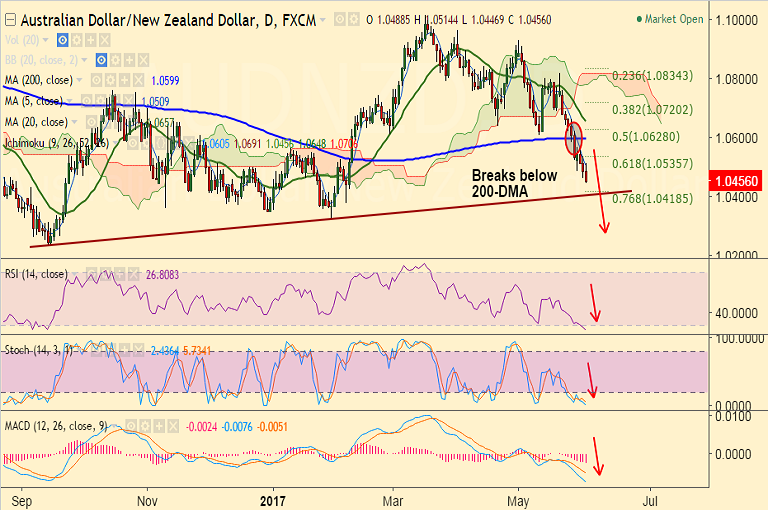

- AUD/NZD slumps to fresh 3-month lows at 1.0413, bias remains bearish.

- Recovery attempts post release of Australia New Home Sales data failed to sustain.

- Data released earlier today by Australia's Housing Industry Association showed a 0.8% m/m rise in new homes sales, a strong rebound from 1.1% fall seen in March.

- The pair was rejected at highs around 1.0454, slips to currently trade at 1.0415 levels.

- Major trendline support is seen at 1.040 levels, break below will see further drag.

Support levels - 1.040 (trendline), 1.0354 (Dec 29 & 30 2016 low), 1.0326 (Jan 31 low)

Resistance levels - 1.0484 (5-DMA), 1.0535 (61.8% Fib), 1.0599 (200-DMA), 1.0642 (20-DMA)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-AUD-NZD-slumps-to-fresh-multi-week-lows-bias-lower-test-of-104-likely-733677) has hit TP1&2.

Recommendation: Book partial profits at lows. Lower trailing stops to 1.0535, hold for further downside.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -51.2033 (Neutral), while Hourly NZD Spot Index was at 4.96674 (Neutral) at 1000 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.