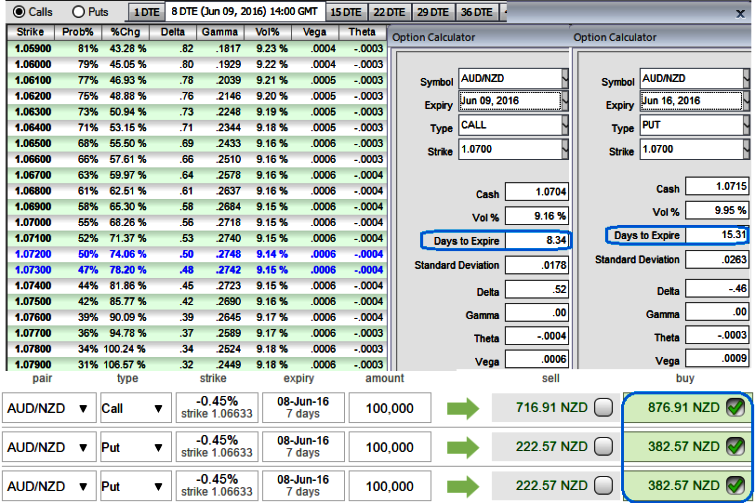

It was exactly a week ago that we had advocated diagonal option strips strategy to upbeat both upswings and downswings. For now, longs on calls with 2w expiry are favoured by ongoing rallies.

The Aussie dollar jumped as the 1.1% gain in Q1 GDP is a stronger result than forecasted at 0.6% (previous 0.7%) and suggests that the economy is weathering the downturn in mining investment well. Solid consumer spending and strong growth in both housing construction and services exports are helping to drive the transition to non-mining growth.

Multi-month, though, there is a case for higher, towards 1.1200, given it is currently well below fair value implied by interest rates, commodity prices and risk sentiment.

On the flip side, although markets have fully priced in a 2.0% OCR, they are aware the risks for the RBNZ are mainly to the downside and see potential for the OCR to fall below 2.0% if global shocks materialize.

On data front, Aussie retail sales & trade balance and Kiwis GDT price index are scheduled to be announced today , RBA and RBNZ's monetary policy seasons are lined up for the next week.

The RBA surprised by cutting in May, which suggests another cut to 1.5%, probably in August. The RBNZ is expected to cut to 1.75% in June.

With both central banks behaving similarly near term, we would expect the cross to consolidate around 1.07-1.09 during the weeks ahead.

OTC Updates & Strategy Tracking:

1w ATM IV is at 9.16%, likely to inch higher at 9.95% in 2w tenors (because we had selected 1m expiries in our last recommendation, please refer below link for our previous write up).

Now, have glance on %change in ATM calls that are flashing with exponential returns and compare the difference in premiums on call and puts.

Profits from short term calls & Losses on puts but yet to expire (3 more weeks to go).

But from now onwards, we look ahead for the slumps as the put with juicy gamma on these strikes.

While gamma is drifting healthily when we shift 50 pips either side, slightly conducive to put strikes with higher likelihood of these strikes finishing in the money.

We've still been firm to hold on this strategy on hedging grounds. The potential target on upside is about 50-100 pips where 100-130 pips on downside.

As stated in our previous write up, the rationale is that any potential downswings should be optimally utilized, so to participate in that downtrend, weights in the portfolio should be doubled with ATM puts.

Hence, shorter expiries (15D) on At-The-Money 0.50 delta call and simultaneously hold 2 lot of longer expiries (1M) At-The-Money -0.50 delta put options.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures