Fundamental medium term outlook of AUD/USD: While further gains to around 0.77 are possible during the month ahead, driven in part by the faltering US dollar and yield-chasing flows, the AUD is losing energy (perhaps a reflection of its declining yield advantage). By year end, there’s a case for a correction towards 0.74 if the Fed tightens in December as we expect. (13 Sep).

The stakes are high this week. A big shift in the trajectory of inflation in Australia would threaten both our view that the market will not move to price in hikes into the OIS strip, and that the AUD remains capped, with a range top at USD 0.7850.

However, this is not our core view. A number of factors (rising under-employment, retail sector competition, and soft rental markets) all continue to suggest that we have not reached a significant point of inflection for core inflation. As such, the strategy into the number is to sell any strength in the AUD or any attempts to price in a tightening track for the RBA.

OTC updates & hedging strategy:

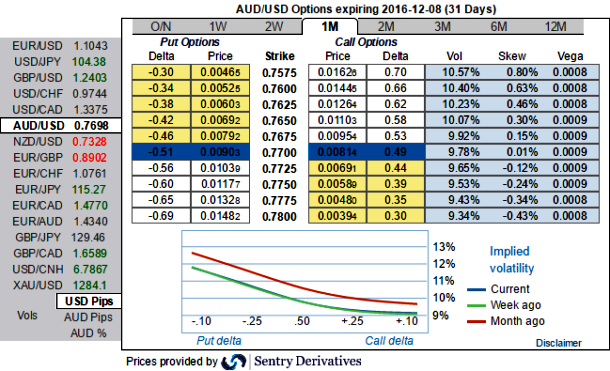

Let’s have a glance on the implied volatility of at the money contracts of near month expiry of this APAC pair that has been spiking shy above 9.75% for 1m expiry, IV skews emphasize the interest of downside risks and hence, we uphold the OTC sentiments towards OTM put strikes.

Simultaneously, the delta risk reversal across various tenors divulge more interests in hedging activities for downside risks.

As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.7725 levels. So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings and bid on 1m IV skewness and risks reversal indications.

AUDUSD's lower IV with negative delta risk reversal can be interpreted as the market reckons the price has downside potential for large movement in the days to come which is resulting option writers on competitive advantage and making derivatives instruments for downside risks have been overpriced and fresh shorts are more on the cards.

Well, we construct option strategy comprising of both calls as well as puts in the ratio of 3:1 so as to suit the swings on either directions contemplating the above risk reversal computations.

The strategy reads this way, go short in 1m OTM calls and simultaneously, 3 lots of 2m puts (+1% ITM, ATM and +1% OTM strikes) are preferred to suit the prevailing losing streaks. So thereby the combination would be executed for net debit and the cost is reduced by short side.

Moreover, the strategy could be counterproductive as the skews in 1m IVs favors OTM puts strikes.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential