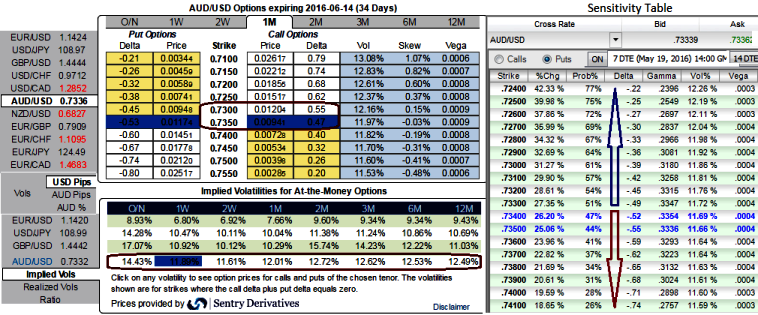

OTC IVs and sensitivity table, we consider 1M ATM IVs at 12.00% at spot FX 0.7332 levels which is still the highest among G10 currency pool and 11.89% for 1W tenors.

The implied volatility here is significant while trading FX options, as the price of FX option depends on future volatility, although it is impractical for anyone to guess accurate future volatility, however, it is possible to calculate the marketplace’s expected future volatility using the option’s price itself.

One of the most interesting aspects of volatility analysis is the phenomenon known as a price skew. When options prices are used to compute implied volatility (IV), what becomes apparent from a look at all the individual option strikes and associated IV levels is that the IV levels for each strike are not always the same - and that there are patterns to this IV variability.

If you shift the view on lower strikes (let’s say 0.7250) the skew is rising to 0.37%.

Skew refers to the situation where at a given strike price, IV will either increase or decrease as the expiration month moves forward into the future.

When a skew develops into a smile, there is an expectation of greater price movement in the future, causing the chart pattern to turn up into a smirk or smile.

Subsequently, let’s have glance on sensitivity table for the different rate scenarios and their probabilistic outcomes. We've just referred 0.25% OTM strikes and their vols, it showed 0.42 as delta values for underlying outrights, that means 42% chances of finishing in-the-money.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise