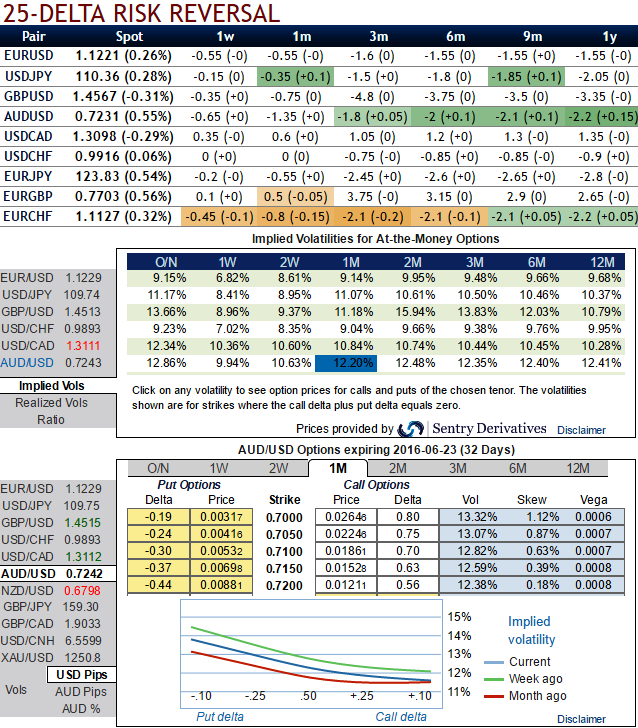

OTC IVs and sensitivity table, we consider 1M ATM IVs at 12.00% at spot FX 0.7332 levels which is still the highest among G10 currency pool and 11.89% for 1W tenors.

The pair still signals highest bearish sentiments among G10 currency space in next 1 month’s timeframe.

So, you would cross the threshold into a risk reversal if you want to hedge your underlying risk while lowering the cost of the premiums. Here OTC FX market indicates, this APAC currency pair seems more sensitive towards downside risks, as a result puts looks to be overpriced.

Market pricing well reflects this view that the RBA will ‘eventually’ ease below 1.5%.

On data front, Aussie is scheduled to announce GDP, retail sales, building permits, consumer confidence and trade balance prints during next week.

If you shift the view on lower strikes (let’s say 100 pips below i.e. 0.7150), the skew is rising to 0.39%.

Skew refers to the situation where at a given strike price, IV will either increase or decrease as the expiration month moves forward into the future.

When a skew develops into a smile, there is an expectation of greater price movement in the future, causing the chart pattern to turn up into a smirk or smile.

Subsequently, if you glance on sensitivity table for the different rate scenarios and their probabilistic outcomes, at spot ref: 0.7250 we've just referred 1.5% OTM strikes and their vols, it showed -0.37 as delta values for underlying outrights, that means 37% chances of finishing in-the-money.

Keeping the above both fundamental and technical factors in mind, it is advisable to go long in 1M (1%) OTM 0.36 delta call while writing 1W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the gold spot price is anticipated to drop moderately in the near term and spikes up in long term.

Trade expects that the underlying gold spot price would drop to ITM strikes on expiration and thereafter bounce back again.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis